- With XRP ETF approval chances at 98% according to Polymarket, analysts anticipate a liquidity boost and broader adoption.

- The upcoming FOMC meeting on June 17–18 could influence XRP prices. Market speculation points to a potential 25-basis-point rate cut.

Ripple’s native crypto XRP has underperformed the rest of the altcoins market over the past month, and is currently trading around the $2.2 level. However, June could be a game-changer for XRP investors considering average returns of 8.5% this month, over the past 11 years. As a result, market optimism surrounding the Ripple crypto is rising once again, with analysts citing three developments that could lead to an upside trajectory.

Approval of Spot XRP ETF

A significant development ahead in the Ripple ecosystem for the month of June is the U.S. Securities and Exchange Commission’s (SEC) anticipated ruling on Franklin Templeton’s proposed Spot XRP ETF, expected by June 17. If approved, the ETF would allow institutional and retail investors to invest in XRP through traditional financial platforms directly, eliminating the need for cryptocurrency wallets.

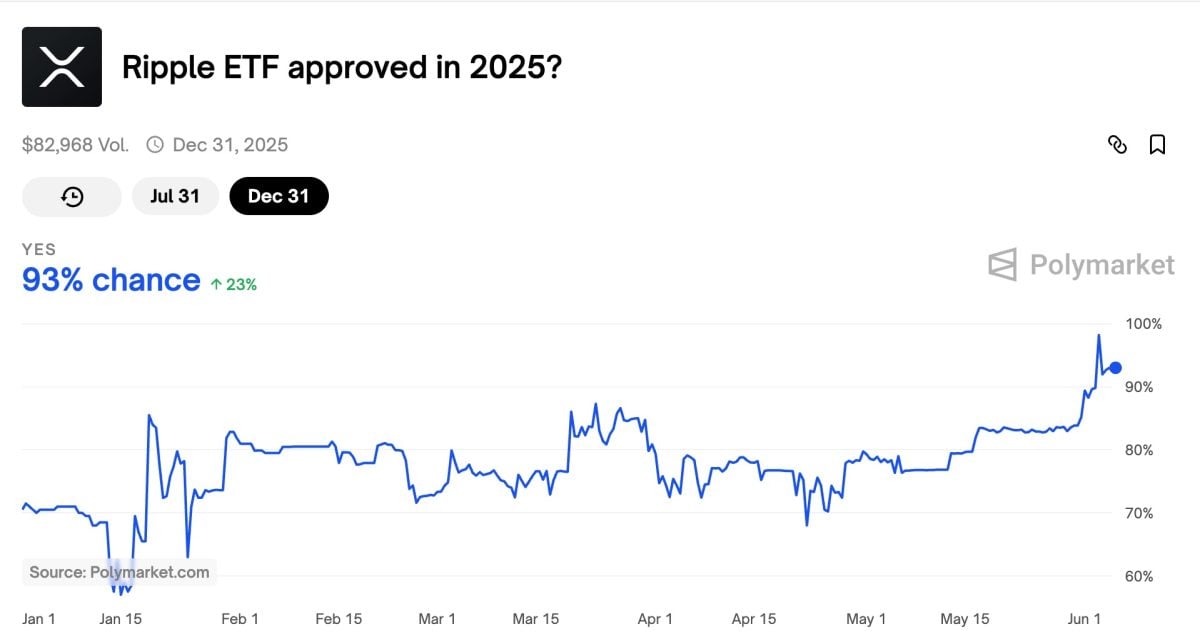

The probability of the U.S. Securities and Exchange Commission (SEC) approving an XRP exchange-traded fund (ETF) soared to 98% on June 3, according to decentralized prediction platform Polymarket.

Currently, Polymarket estimates a 93% likelihood of approval by December 31, 2025. This reflects a notable 23% increase over the past month, even amidst repeated delays by the securities regulator. Prominent analyst Cekky Crypto predicts that this approval could have a transformative effect on XRP, akin to Bitcoin’s ETF launch in early 2024. This launch could certainly provide a major liquidity boost to the Ripple cryptocurrency.

The Possibility of Fed Rate Cuts to Influence Price

All eyes are currently on the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) meeting, set for June 17–18, as these macro indicators could play a crucial role in determining the momentum of the Ripple cryptocurrency. Market speculation suggests the Fed may introduce a modest rate cut, potentially around 25 basis points.

If implemented, this could be a major pivot from months-long dovish policy, potentially reigniting investor interest in risk-on markets, including altcoins like XRP. Historically, rate cuts have driven capital into technology stocks and cryptocurrencies. Analyst Cekky highlights that XRP could gain from such an environment, noting that digital asset markets often experience broad rallies after such events.

XRP Whale Activity On the Rise

A third bullish signal is the accumulation trend observed near the $1.90 level. On-chain data reveals that large XRP holders, or “whales,” have been steadily increasing their positions, seemingly in preparation for upcoming market catalysts. Furthermore, firms like VivoPower have announced that it will start building their XRP Treasury.

Crypto analyst Cekky views this as a critical indicator, noting that while risks remain, such as potential ETF approval delays or a hawkish stance from the Federal Reserve, the “risk-reward is heavily skewed in favor of bulls.” He describes the current phase as “the last calm before the XRP storm,” expressing optimism for a significant price breakout.

Historically, June has been a challenging month for XRP holders, but the convergence of these factors could signal a pivotal moment, setting the stage for a potential rally