More than $700M flowed out of US spot Bitcoin ETFs in a single day this week, marking the sharpest pullback in two months. Let’s dive into why is crypto crashing?

According to Bloomberg’s latest report on January 21, investors pulled roughly $709M from spot Bitcoin ETFs listed in the US. It was the biggest daily outflow since November 20.

The exit followed a stretch of market tension sparked by President Donald Trump’s renewed tariff threats against Europe.

His comments raised fresh fears of a broader trade conflict and pushed investors out of risk assets across global markets.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

What Does the Drop in Crypto Market Cap Say About Investor Sentiment?

Bitcoin slipped below $88,000 during Tuesday’s sell-off before stabilizing in the upper-$89,000 range.

The total crypto market cap fell about 2–3% over 24 hours, holding just above the $3 trillion mark.

The shift in flows stands in sharp contrast to early January, when spot Bitcoin ETFs pulled in about $1.4Bn in net inflows over a single week.

The sudden reversal shows how quickly sentiment has turned as trade headlines and rising bond yields dominate the macro picture.

Derivatives data points to de-risking rather than a full unwind. CoinGlass data shows Bitcoin futures open interest near $58.5Bn, with about $63.5Bn traded in the past 24 hours.

Liquidations sit around $110M, while Bitcoin trades close to $89,500.

Across the wider crypto market, futures open interest is near $132Bn, set against $260Bn in daily volume.

Roughly $600M in positions were cleared out over the past day, suggesting cautious repositioning instead of panic.

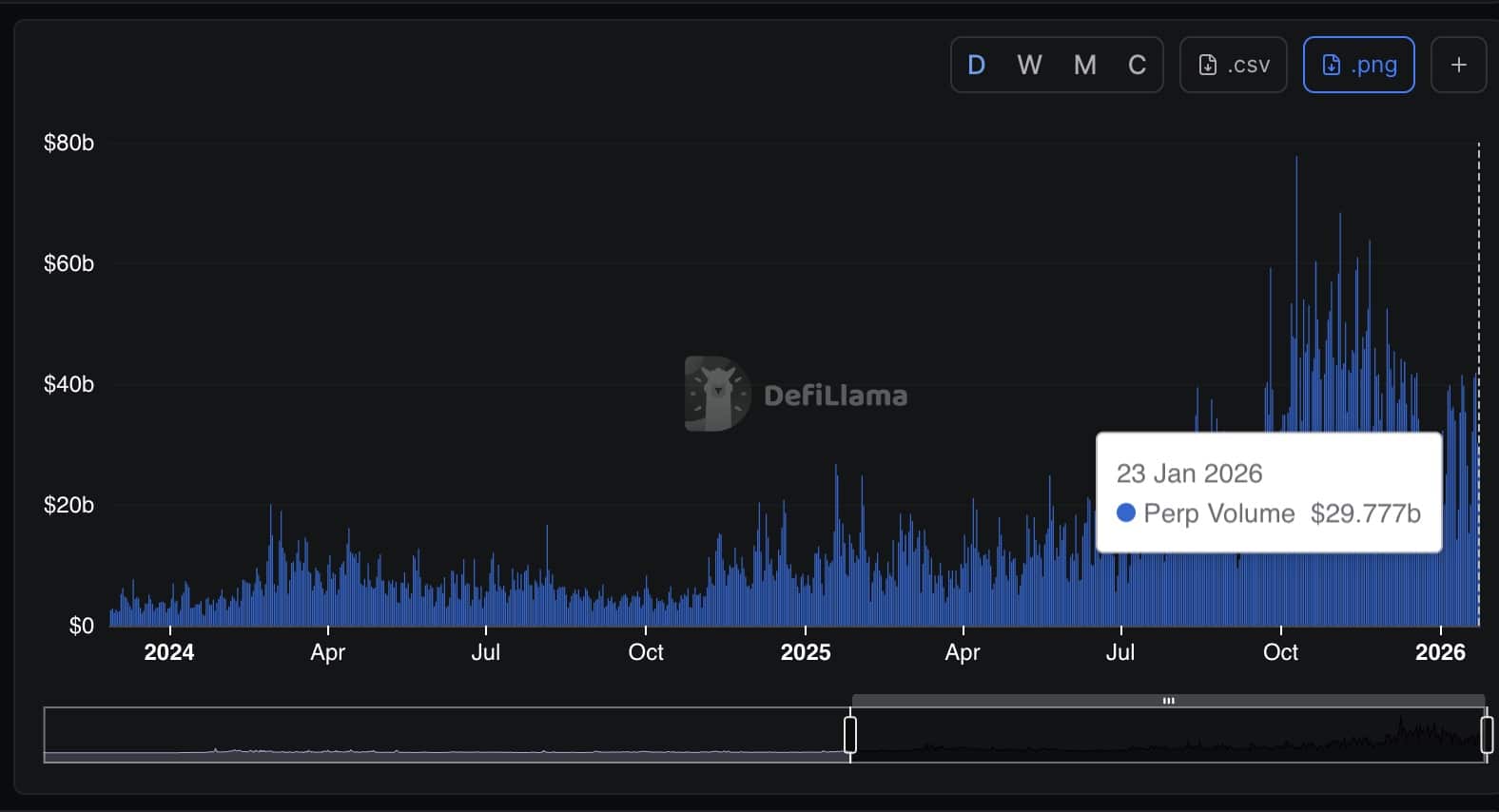

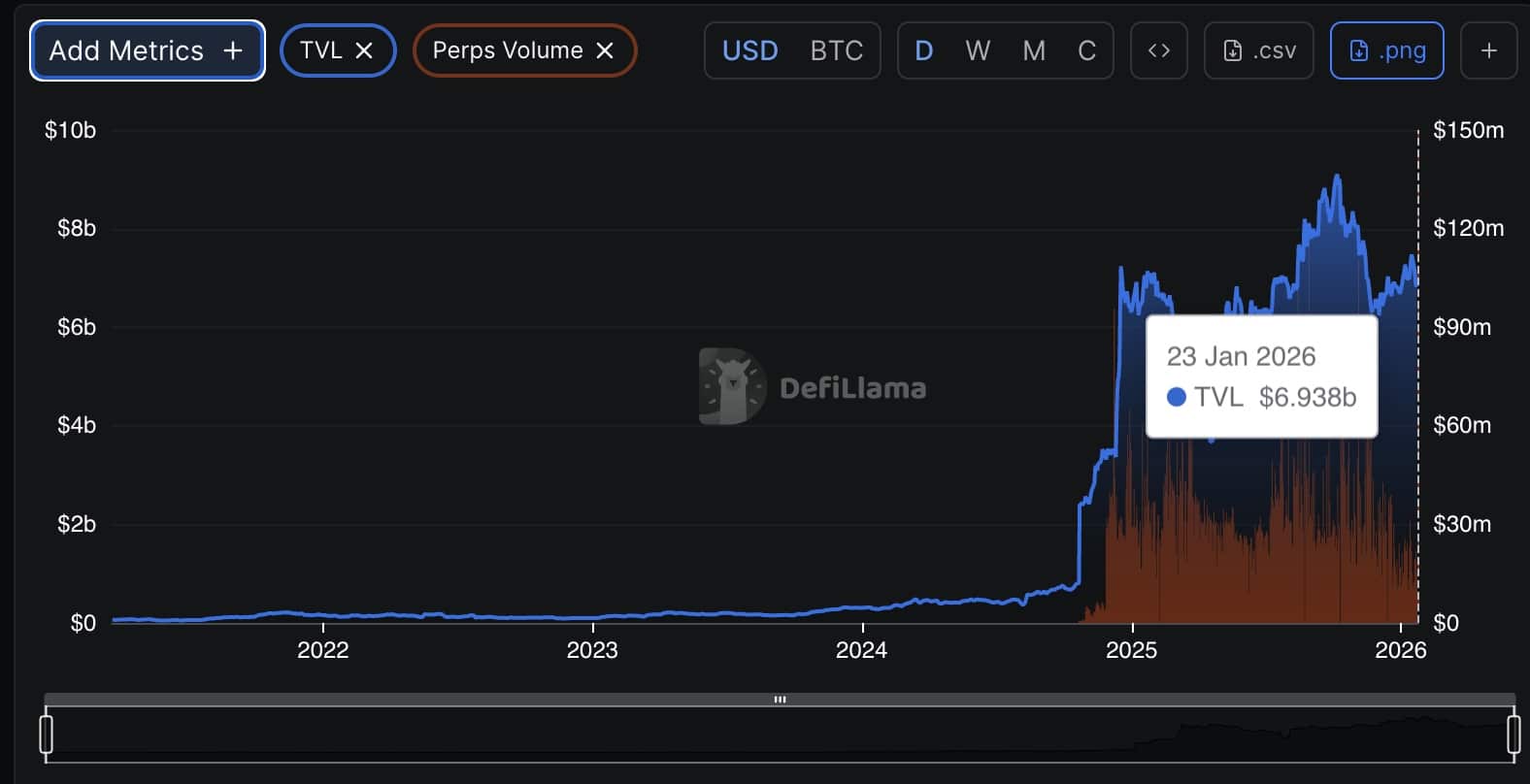

DefiLlama’s dashboard puts perpetuals open interest just above $19Bn, with $30.2Bn in 24-hour volume a mild drop from last week.

Bitcoin’s share of on-chain trading remains small. Its native chain saw about $0.7 million in spot DEX volume and $15 million in perp flows, compared with nearly $14.4Bn in spot trades across global DEXs.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Do Rising Bitcoin Exchange Inflows Signal Short-Term Selling Pressure?

Bitcoin’s on-chain flows shifted this week as more coins moved toward selling venues.

Data cited by Ali Charts shows about 15,000 BTC flowed into centralized exchanges over the past seven days. At current prices, that stash is worth roughly $1.35Bn.

15,000 Bitcoin $BTC, worth roughly $1.35 billion, were sent to crypto exchanges over the past week, according to data from @glassnode. pic.twitter.com/hxiXb6q8wY

— Ali Charts (@alicharts) January 23, 2026

On-chain data from Glassnode shows exchange balances rising again after a brief period of steady outflows earlier this month.

Traders usually watch these inflows closely because they can point to fresh selling pressure or short-term positioning.

The shift comes as Bitcoin trades near important technical levels, keeping sentiment cautious for now.

Ethereum’s performance against Bitcoin has weakened.

The ETH/BTC pair slipped below its 200-day moving average and its 200-day exponential moving average on the daily chart, showing a clear drop in longer-term momentum.

$ETH Lost the Daily 200MA/EMA relative to $BTC but is still holding on to that 0.032 level.

Seeing price barely moved for the past 3 months, I think a large volatility expansion is likely.

Big level to defend here for the bulls to make sure that move isn't against them. pic.twitter.com/ExRRxAaeeo

— Daan Crypto Trades (@DaanCrypto) January 23, 2026

Even with that break, Ethereum is still holding the 0.032 level against Bitcoin. Traders have treated this zone as a key line in the sand.

The pair has moved sideways for almost three months, with little direction and tight price action. That kind of compression often signals that a larger move is building.

Market analysts say the 0.032 area remains the level buyers need to protect. A firm drop below it would hand more momentum to Bitcoin and could set the stage for a sharper shift in the trend.

DISCOVER: 10+ Next Crypto to 100X In 2026

Key Takeaways

- According to Bloomberg’s latest report on January 21, investors pulled roughly $709M from spot Bitcoin ETFs listed in the US. It was the biggest daily outflow since November 20.

-

Bitcoin’s share of on-chain trading remains small. Its native chain saw about $0.7 million in spot DEX volume and $15 million in perp flows, compared with nearly $14.4Bn in spot trades across global DEXs.

The post Why Is Crypto Crashing? Record $700M Exits Bitcoin ETFs in Single Day as Wall Street De-Risks Ahead of Trade War appeared first on 99Bitcoins.