Key Takeaways

- Wells Fargo increased its stake in BlackRock’s iShares Bitcoin Trust from $26 million to over $160 million in Q2 2025.

- The bank also expanded its investments in other Bitcoin ETFs, including Invesco Galaxy Bitcoin ETF (BTCO) and Grayscale’s funds.

Share this article

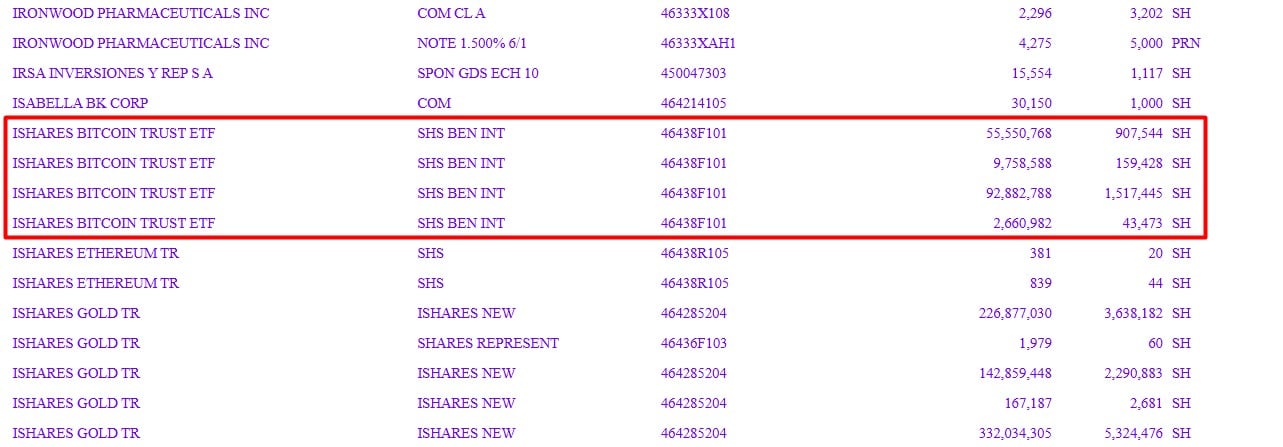

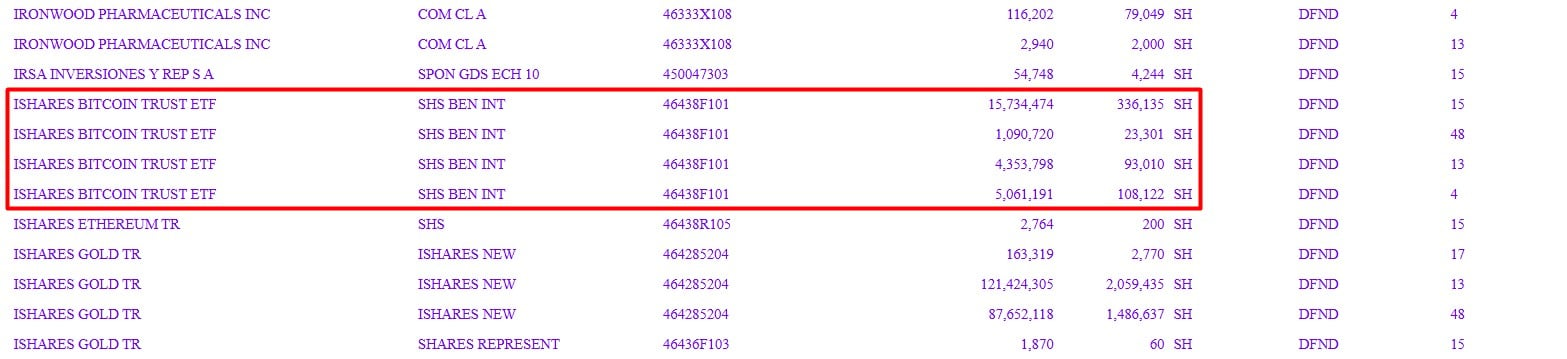

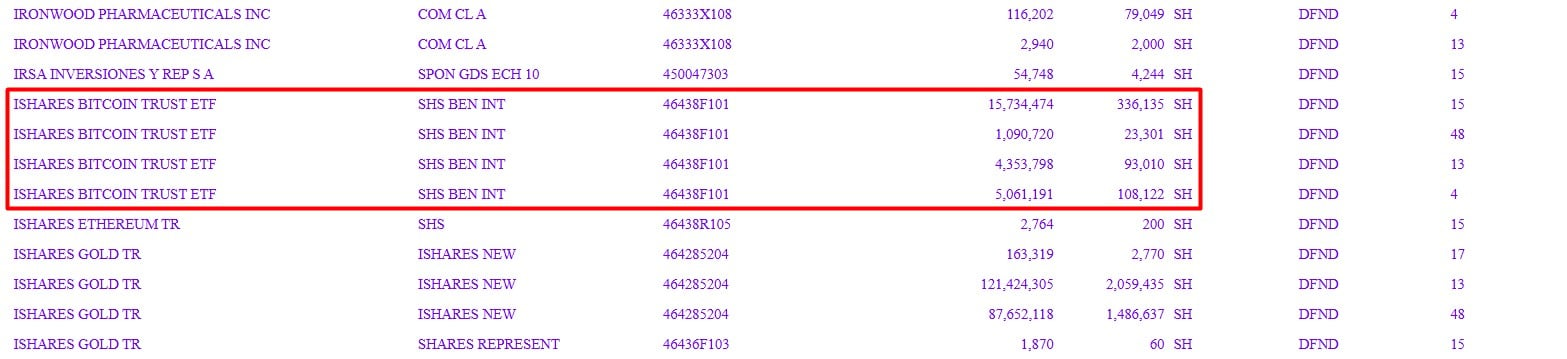

Wells Fargo increased its holdings in BlackRock’s Bitcoin ETF, the iShares Bitcoin Trust (IBIT), during the second quarter of 2025, according to a new SEC filing.

The fourth-largest bank in the US by asset size disclosed that it held over $160 million worth of IBIT shares as of June 30, up from over $26 million at the end of the first quarter, the filings shows.

Bloomberg reported last February that Bank of America’s Merrill and Wells Fargo started providing spot Bitcoin ETFs to brokerage clients in their wealth management units upon request.

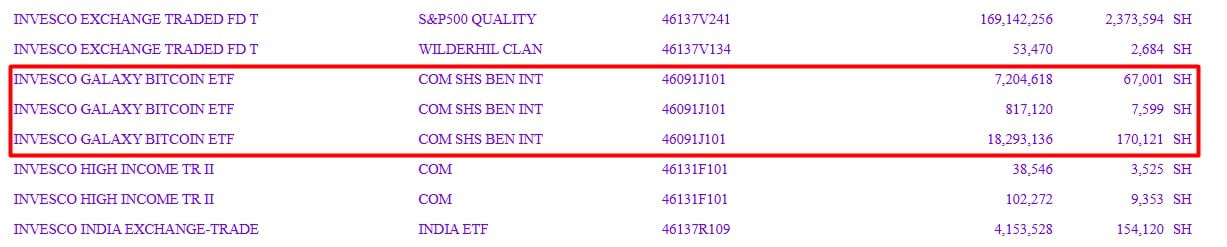

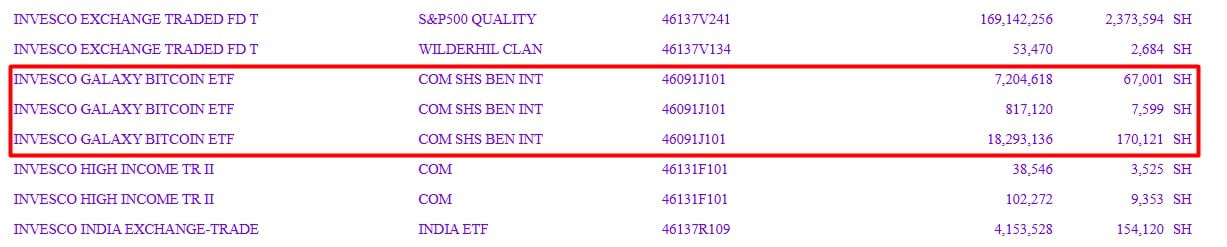

In addition to IBIT, Wells Fargo boosted its stake in the Invesco Galaxy Bitcoin ETF (BTCO) from $2.5 million to around $26 million in Q2.

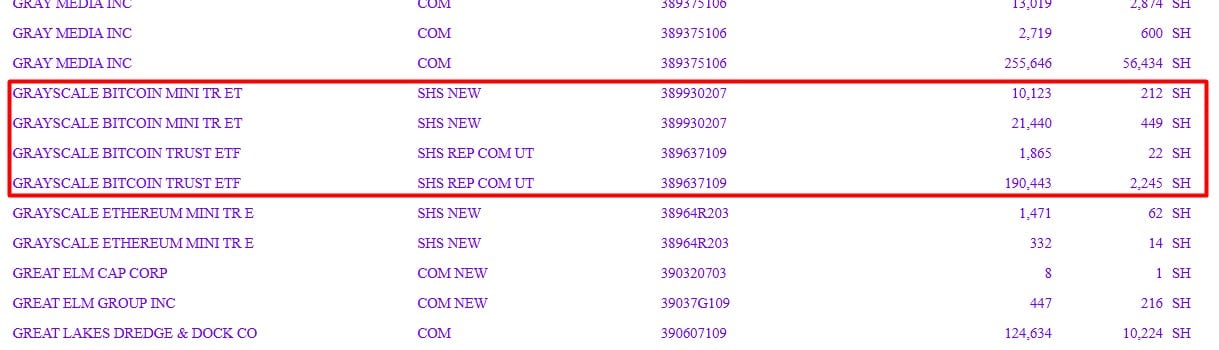

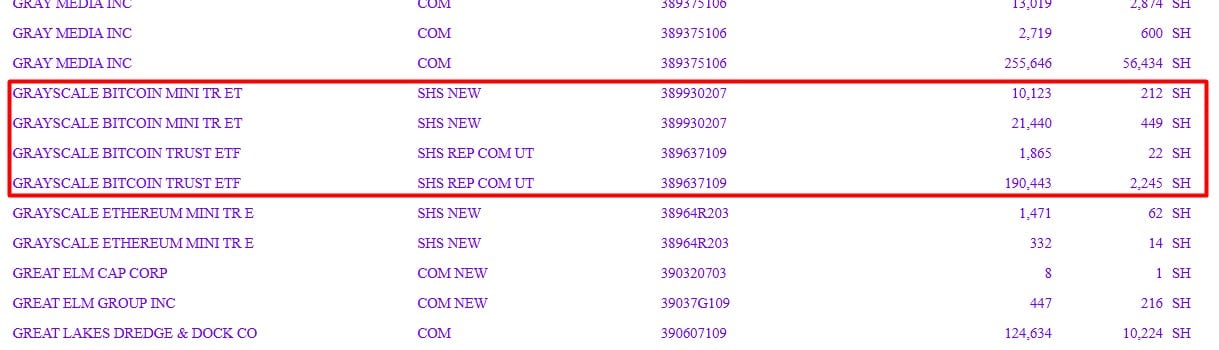

Between March and June, Wells Fargo’s stake in the Grayscale Bitcoin Mini Trust also grew from about $23,000 to $31,500, and its GBTC holdings climbed from $146,000 to over $192,000.

The firm also reported smaller positions in Bitcoin funds managed by ARK Invest/21Shares, Bitwise, CoinShares/Valkyrie, Fidelity, and VanEck, as well as spot Ethereum ETFs.

In related developments, Abu Dhabi’s sovereign wealth fund Mubadala maintained its position of 8,7 million IBIT shares valued at $534 million as of June 30, according to an SEC filing.

Al Warda Investments, managed by the Abu Dhabi Investment Council, reported holding 2,4 million IBIT shares worth $147 million at the end of June.

Share this article