Key Takeaways

- Major DCP issuer Guggenheim launches US Treasury-backed Digital Commercial Paper on the XRP Ledger.

- At its launch on Ethereum, Guggenheim issued $20 million of DCP, which received the highest credit rating from Moody’s, P-1.

Share this article

Guggenheim Treasury Services, one of the largest and most respected asset-backed commercial paper issuers, is bringing its flagship on-chain Digital Commercial Paper (DCP) to the XRP Ledger, according to a new report from Bloomberg.

Initially launched on Ethereum last September, DCP is a blockchain-powered form of commercial paper, also known as short-term, fixed-income debut instruments. Companies issue commercial paper when they need to raise quick cash for their immediate operational needs, such as payroll or other short-term financial obligations.

Since Guggenheim started offering DCP on Ethereum, it has processed over $280 million in issuance, as noted in the report. For a new, tokenized financial product, the number indicates that there is genuine and considerable interest from institutional investors in these blockchain-based assets.

The DCP product is fully backed by maturity-matched US Treasury bonds and offered daily through Zeconomy’s platform at customized maturities up to 397 days. When it launched on Ethereum, it received a credit rating of P-1 from Moody’s.

Markus Infanger, Senior Vice President of RippleX, stated that Ripple would invest $10 million in the DCP product and explore its use for payments, including potential purchases with Ripple’s stablecoin.

As of June 9, the total value locked on the XRPL stood at around $61 million, a fourfold increase from $14 million last September, following developments in Ripple’s legal battle with the SEC, according to data from DeFiLlama.

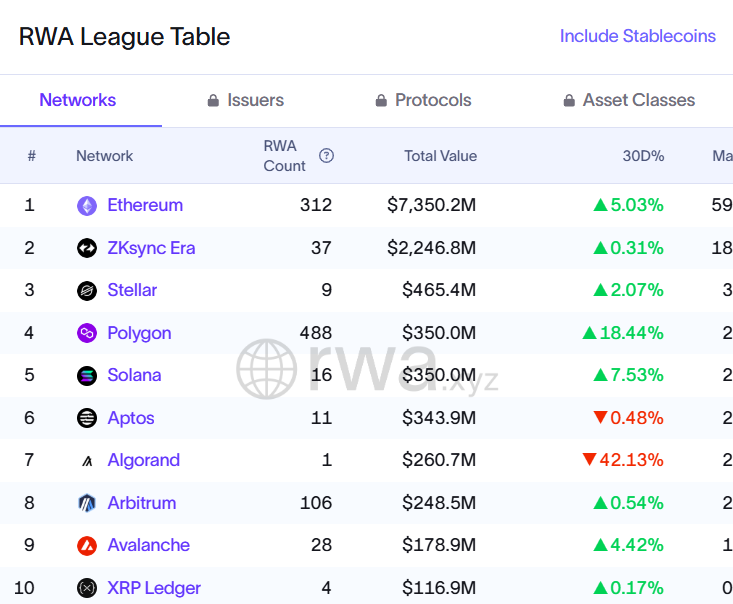

The XRP Ledger currently represents a small portion of the tokenized asset landscape, with about $117 million in tokenized assets, excluding stablecoins, according to data from rwa.xyz.

Ethereum remains the frontrunner in real-world asset (RWA) tokenization, with BlackRock’s BUIDL fund being a major driver of its growth.

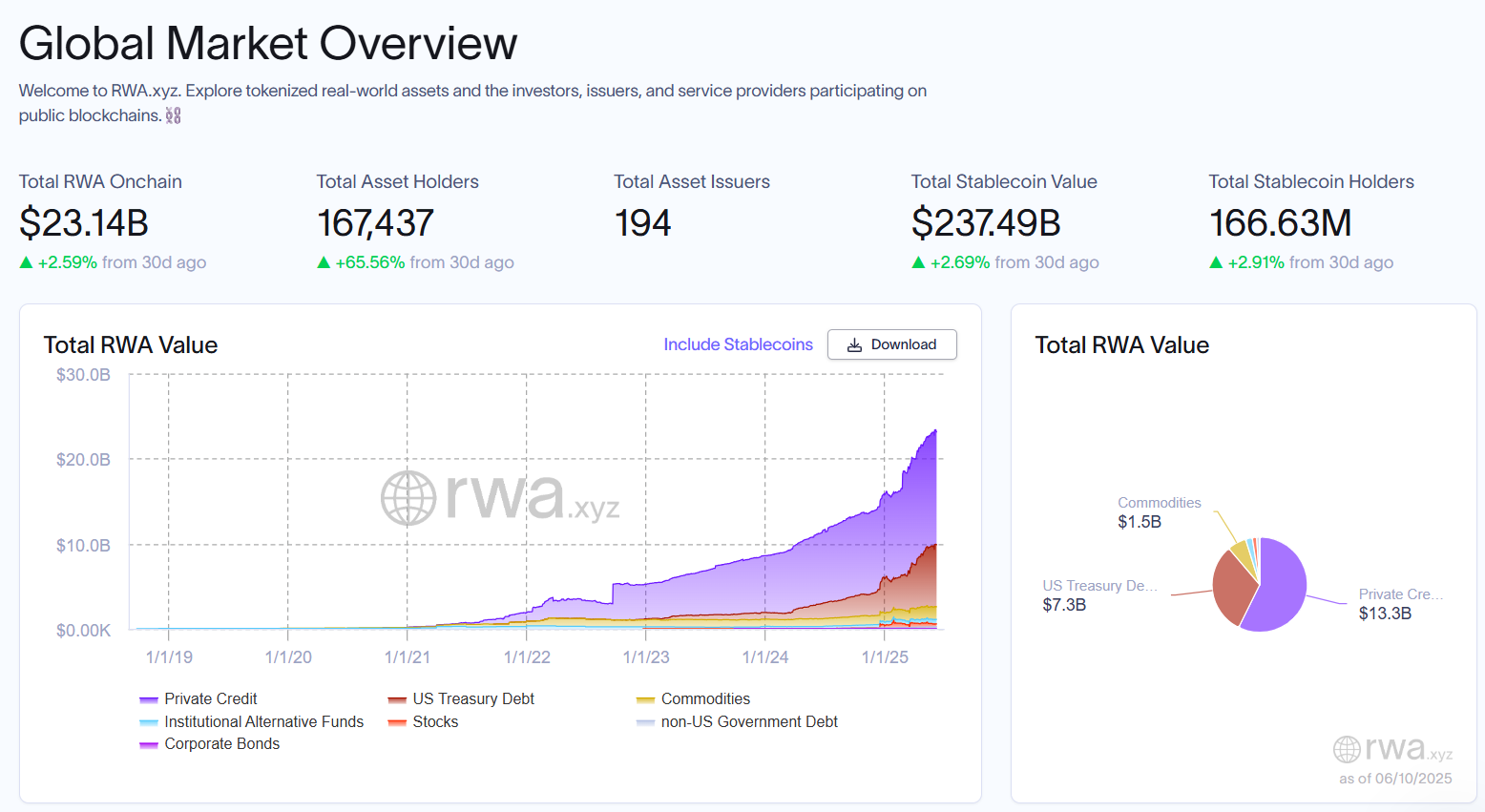

The total valuation of RWA tokenization has surpassed $23 billion, up over 45% so far this year, while the number of asset holders has grown by 65%.

Share this article