Bitcoin value resumed its upward development this week because it crossed the essential resistance at $97,000 and reached its highest stage since February.

Bitcoin (BTC) was buying and selling round $96,500 eventually verify Saturday. That’s up 30% from the bottom in April. This text appears at a number of the high three causes it could surge to a brand new all-time excessive this 12 months.

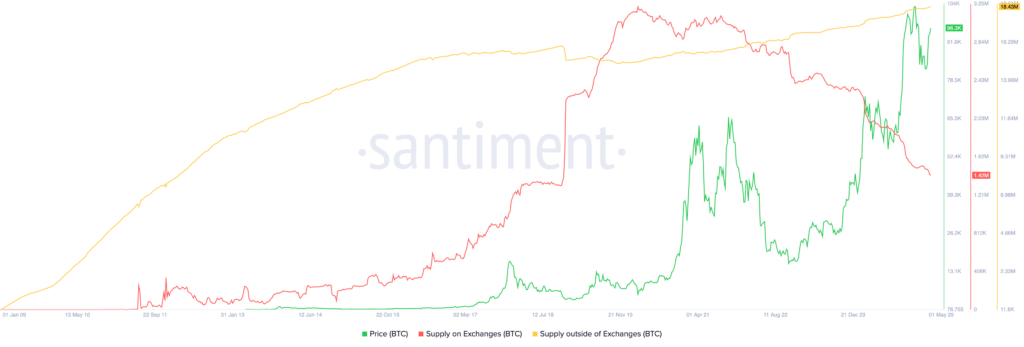

Bitcoin provide in exchanges is falling

The primary major bullish side is that the provision of Bitcoin on exchanges has tumbled to 1.42 million, the bottom stage in over six years. There at the moment are 1.42 million cash on centralized exchanges, its lowest stage since November 2018. The provision stood at 3.21 million at its highest stage in 2018.

Extra information reveals that the provision of Bitcoin outdoors of exchanges jumped to 18.43 million. These numbers imply that buyers aren’t promoting their cash, which can result in a provide squeeze as demand continues rising.

A number of the high Bitcoin holders haven’t any intention to promote any time quickly. Michael Saylor’s Technique, which holds over 2% of the whole provide, is continuous to purchase. Equally, high corporations like Coinbase, Tesla, Galaxy Digital, and Block haven’t hinted that they’ll promote.

Retail and institutional demand is excessive

The opposite high cause why the value of Bitcoin will doubtless hold rising is that retail and institutional demand continues to extend.

One indicator of that is Bitcoin exchange-traded fund inflows. SoSoValue information reveals that Bitcoin ETFs have had solely 4 months of outflows since their inception in January final 12 months.

These funds have cumulatively added over $40 billion in belongings. Blackrock’s IBIT has $60 billion in belongings, whereas Constancy’s FBTC and Ark Make investments’s ARKB have $20 billion and $19 billion, respectively.

Rising ETF inflows are an indication of institutional demand within the U.S. Additional, there are indicators that the following part of demand will come from international locations looking for to diversify from the U.S. greenback.

These provide and demand dynamics clarify why analysts are extremely bullish on Bitcoin. Standard Chartered analysts see the coin leaping to $200,000, whereas Ark Make investments expects it to leap to $2.4 million in 2030.

As well as, Bitcoin’s demand is anticipated to rise as trade tensions ease.

Bitcoin value technical evaluation

Lastly, Bitcoin’s value has robust technicals that will push it a lot increased in the long run. It has remained above the ascending trendline, connecting the bottom swings since Aug. 5 final 12 months.

Bitcoin has jumped above the important thing resistance stage at $88,690, the neckline of the double-bottom sample. It has additionally jumped above the 50-day and 100-day Exponential Shifting Averages.

Subsequently, there are indicators that it’s gaining momentum, which can push it above $100,000 first after which to its all-time excessive.