With the BTC USD price below $100,000, Bitcoin prediction models are bearish. The bad news is that it could get worse, especially if digital gold crashes below $90,000.

Every time the Bitcoin price ticks lower, MicroStrategy, the world’s largest holder of BTC, comes under renewed pressure. Last week, when BTC USDT fell below $100,000, MicroStrategy’s net asset value (NAV) fell below 1.

Microstrategy mNAV drops to ~1x, cash on hand is $54mm,

Assuming all regular debt is 0% (it's not), and $STRF/ $STRK preferreds are 8% or 10%. $MSTR will either sell stock, pay dividends in stock, or as a last resort sell $BTC (would be disastrous in terms of optics), thereby… pic.twitter.com/nysxTi2Qy4— baran (@barankayhan) November 12, 2025

That was enough of a scare because it meant everything the public company held was less than the value of its Bitcoin holdings. Would they be willing to sell if the situation becomes dire? Will investors demand action and protection?

DISCOVER: 20+ Next Crypto to Explode in 2025

Peter Schiff Says MicroStrategy and Michael Saylor Are Fraudsters

For MicroStrategy and Michael Saylor, their reputation depends on whether Bitcoin and some of the best cryptos to buy will recover. If not, there is a real risk that Saylor will be labeled a fraudster and MicroStrategy a big Ponzi as some critics claim.

Among those firing shots now that Bitcoin prices are shaky is Peter Schiff. Schiff is a big gold advocate and always thinks Bitcoin and most “store-of-value” cryptos don’t have a future.

Interestingly, Schiff has no problem with Saylor as a person. Instead, he is worried about the business model that MicroStrategy has employed. On Sunday, he called their treasury a fraud and even challenged Saylor to a debate at the Binance Blockchain Week in Dubai set for December.

In a post on X, Schiff thinks MicroStrategy’s model of relying on funds to buy its “high-yield” preferred shares is unsustainable. Schiff is skeptical whether the promised high yield will be paid in the first place.

MSTR’s entire business model is a fraud. Saylor and I will both be speaking at Binance Blockchain Week in Dubai in early December. I challenge @saylor to debate this proposition with me. Regardless of what happens to Bitcoin, I believe $MSTR will eventually go bankrupt. Let’s go!

— Peter Schiff (@PeterSchiff) November 16, 2025

If they never follow through, he predicts a situation where investors will rush for the exits and dump MSTR preferred shares, causing a death spiral impacting Bitcoin and even some of the best Solana meme coins.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Bitcoin Prediction: Will the BTC USD Price Dump Continue?

Still, Bitcoin and crypto traders are optimistic.

Even after the MSTR mNAV fell below 1 last week before recovering to around 1.2 at press time, way lower than the ideal 2, MicroStrategy didn’t sell BTC.

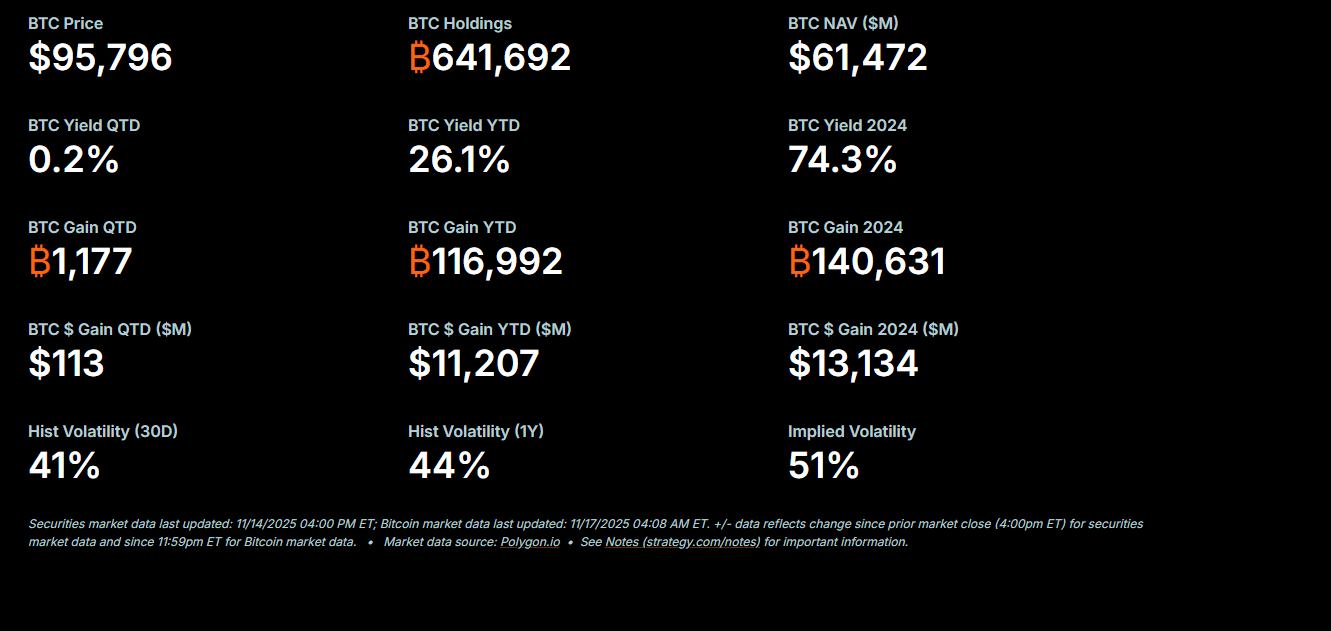

From data, their Bitcoin NAV, that is, the market value of its Bitcoin holdings, stands at $61,487, offering a 26.1% yield year-to-date at spot Bitcoin rates.

(Source: Strategy)

Looking at the Bitcoin daily chart, there is a floor at $93,000. If buyers load up at this level, pushing prices higher, ideally above $100,000, MicroStrategy will find a breather.

Conversely, any drop below last week’s low could see bears push the Bitcoin price closer to the Bitcoin NAV, negatively impacting MicroStrategy’s prospects.

On X, one analyst suggests that if the BTC USD price falls further and MicroStrategy is forced to sell due to a falling NAV, the Bitcoin price could collapse by over 30%.

Breaking: MicroStrategy just traded BELOW its Bitcoin holdings value for the first time since 2024.

The 300% premium era is dead.

And the forced-selling cascade that could tank Bitcoin 30–50% is now closer than ever.

Here’s the cold truth nobody wants to say out loud.… pic.twitter.com/U1QGTi3aZK

— Andrea Lisi, CFA (@Andrea_Texas_82) November 15, 2025

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Peter Schiff Calls Saylor A Fraudster: Bitcoin Prediction For 2026?

- Bitcoin prediction models bearish

- BTC USD price capped below $100,000

- Peter Schiff calls Michael Saylor of MicroStrategy a fraudster

- Will falling BTC USDT force MicroStrategy to sell?

The post Peter Schiff Calls Saylor A Fraudster, Bitcoin’s YTD Gains Evaporated Last Week: Bitcoin Prediction For 2026 Close? appeared first on 99Bitcoins.