Now that the bull run is dead, will Fed Chair Jerome Powell do further rate cuts? This crash proved two things :

1. Always DCA into bitcoin

2. Hold and assume it’s a lifetime investment

Meanwhile, Powell signaled this week that the central bank could be nearing the end of its three-year effort to unwind the massive stimulus unleashed during the 2020 pandemic. Speaking before the National Association of Business Economics in Philadelphia, Powell said the Fed may soon conclude its balance-sheet reduction.”

“We may approach that point in the coming months,” Powell said, noting that policymakers have adopted a “deliberately cautious approach” to avoid a repeat of the 2019 money market freeze that forced emergency intervention.

Here’s the best case: the US government sputters back to life within 7–12 days. Here’s what you need to know:

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Will Powell Do Further Rate Cuts? Fed Nears End of Quantitative Tightening

The Fed’s portfolio peaked at nearly $9 Tn during the pandemic’s peak and now stands around $6.6 Tn, according to FRED. The runoff, known as quantitative tightening (QT), has reduced excess bank reserves and raised questions about whether liquidity conditions could again tighten too sharply.

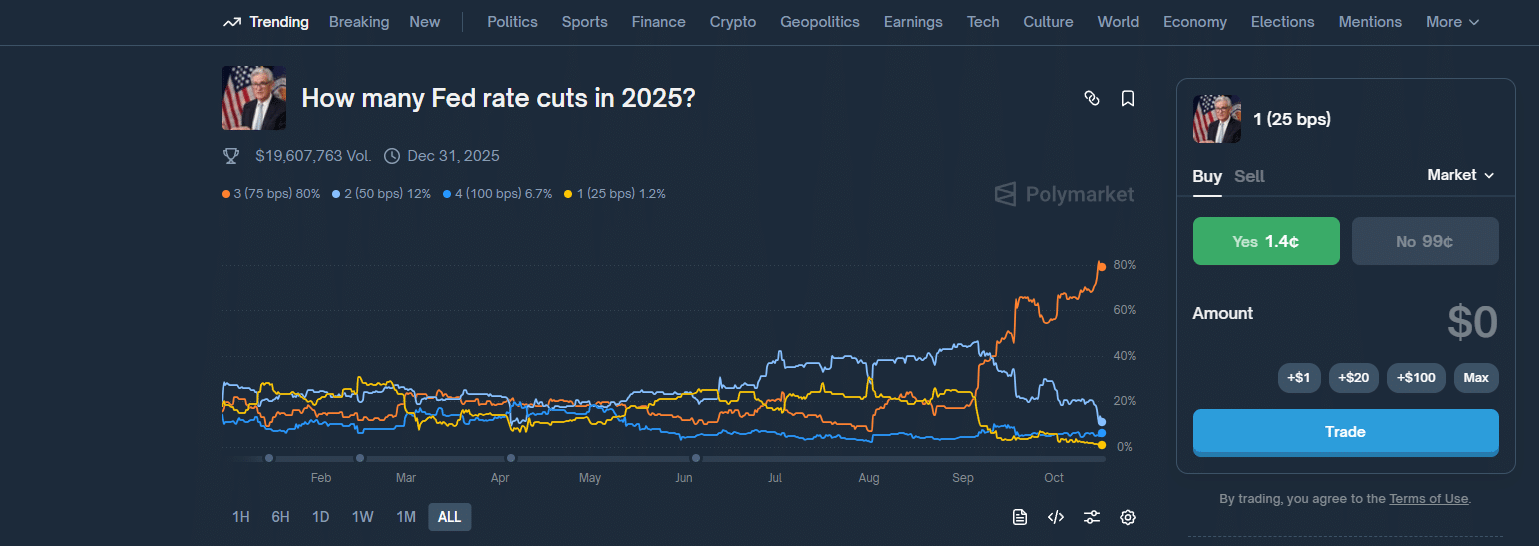

Powell stopped short of confirming an October rate cut but didn’t deny it either, saying the “economic outlook hasn’t changed much” since the Fed’s last meeting. Markets took that as tacit confirmation that another rate cut could be coming, but

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

0.97%

Bitcoin

BTC

Price

$111,674.63

0.97% /24h

Volume in 24h

$65.17B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

responded negatively to the news, dropping 0.5%.

Here’s the best case scenario (we need some good news, right?):

- Once the lights turn back on and the gov’t shutdown is over, the SEC resumes its grind toward altcoin ETF approvals, the narrative everyone’s waiting on.

- Meanwhile, gold dips, the dollar index slides, and the Fed tees up another 25 bps cut on October 29.

- Somewhere between the shutdown headlines and the liquidity flood, the Clarity Act also passes Q4

And as crypto traders overthink every macro move, crypto does what it always does best: melts up while no one’s looking. Maximum pain. Maximum irony… if you’re sitting on the sideline that is.

DISCOVER: 20+ Next Crypto to Explode in 2025

What About the US Shutdown? Gov’t Pressures Job Market and Data Flow

The ongoing federal government shutdown, now in its second week, has suspended the release of key economic data, including the September jobs report. Still, private estimates from JPMorgan, Goldman Sachs, and Citigroup suggest that initial unemployment claims rose to around 235,000 last week, up from 224,000 previously.

“Excluding any shutdown noise, claims still look reasonably low,” added Abiel Reinhart of JPMorgan.

To end the shutdown, Democrats are DEMANDING $1.5 TRILLION in new partisan spending.

This is an unserious proposal made by unserious people.

Here are just a few of the things they are using to take the government hostage

pic.twitter.com/IIyQz16t1P

— Speaker Mike Johnson (@SpeakerJohnson) October 15, 2025

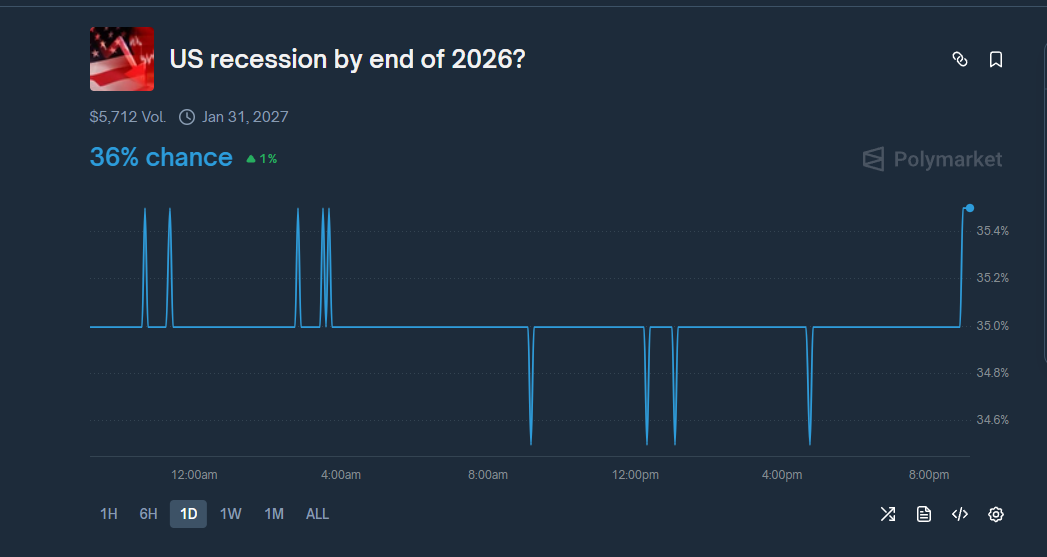

The labor market, while not collapsing, appears frozen in what economists call a “no hiring, no firing” equilibrium. Meanwhile, Wall St. firms remain cautious amid trade friction, automation adoption, and policy uncertainty heading into 2025.

US Economic Data Points to Fragile Momentum, What’s Next?

Job openings are down 9% year-over-year, wages flat near 4.1%, and inflation still grinding higher. With the Fed’s next big data week coming, CPI on Oct. 15, PPI on Oct. 16, payrolls on Oct. 17 , this market looks dead.

But it’s often when you’re most frustrated, bored, and pissed off (same thing as frustrated, but more apt) that things melt up.

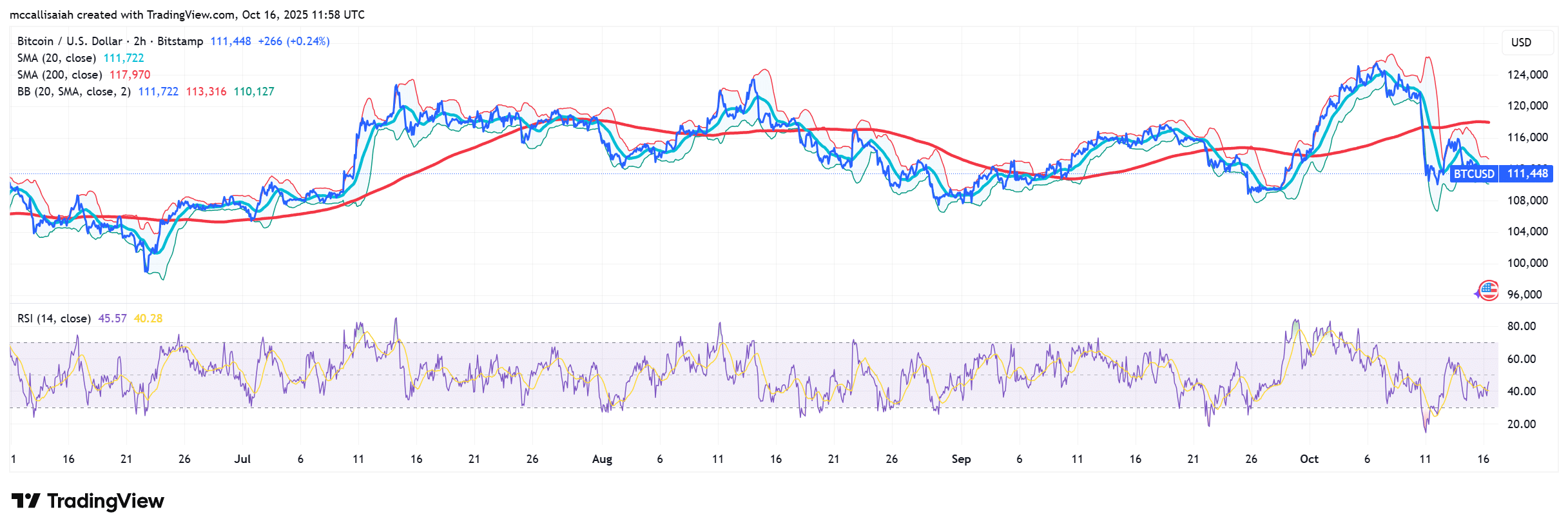

Powell’s signals are softening: QT may be ending, and rate cuts are back on the table. Stocks have perked up, treasury yields are slipping, and Bitcoin’s hovering above $112K. We should still see a new BTC ATH in Q4.

EXPLORE: BNB Meme Season? Hajimi, 币安人生, And Many 100‑1000x Runners.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Now that the bull run is dead, will Fed Chair Jerome Powell do further rate cuts? This crash proved two things :1. Always DCA into bitcoin.

- TJob openings are down 9% year-over-year, wages flat near 4.1%, and inflation still grinding higher.

The post Now That the Bull Run is Dead, Will Powell Do Further Rate Cuts? End of Fed Tightening Near as Job Market Softens appeared first on 99Bitcoins.