MEXC and Crypto.com are leading crypto exchanges offering traders different products/services for storing and trading cryptocurrencies. In this MEXC vs Crypto.com comparison, we look at both platforms’ trading features, products and services, fee structure, security features, and user experience. By the end, you should be able to determine which exchange is better for your trading needs.

MEXC vs Crypto.com: Overview Comparison

| Criteria | MEXC | Crypto.com |

| Best For | Experienced traders seeking a large token list and advanced trading options. | Newer investors and advanced traders looking for an all-in-one crypto platform. |

| Founded | 2018 | 2016 |

| Exchange Features | Low trading fees, MEXC launchpad, institutional services, and copy trading. | On-chain, automated trading tools, NFT marketplace, and institutional services. |

| Trading Options | Pre-market trading, spot trading, and futures/perpetual contracts. | Spot, derivatives, and options. |

| Number of Supported Cryptocurrencies | 3,000+ | 400+ |

| Trading Fees | 0.00% maker and 0.05% taker for spot market

0.08% maker and 0.10% taker for futures. |

0.250% maker, 0.500% taker for spot.

0.020% maker, 0.040% taker for futures. |

| Security Measures | $100M Guardian Fund, cold storage of funds, 2FA, and regular audits. | Offline/cold storage, multifactor authentication (MFA), and a $750M insurance coverage. |

| Native Token | MX Token (MX) | Cronos (CRO) |

| Additional Features | Airdrop+, Meme+, NFT marketplace, demo trading, and leveraged ETFs. | NFT marketplace, staking, Crypto card, and CRO rewards. |

What is MEXC?

MEXC is a global cryptocurrency trading platform known for offering incredibly low transaction fees and a wide range of products and cryptocurrencies. MEXC was launched in 2018 and has since gained massive adoption from global users, with its user base currently above 40 million across 170+ countries.

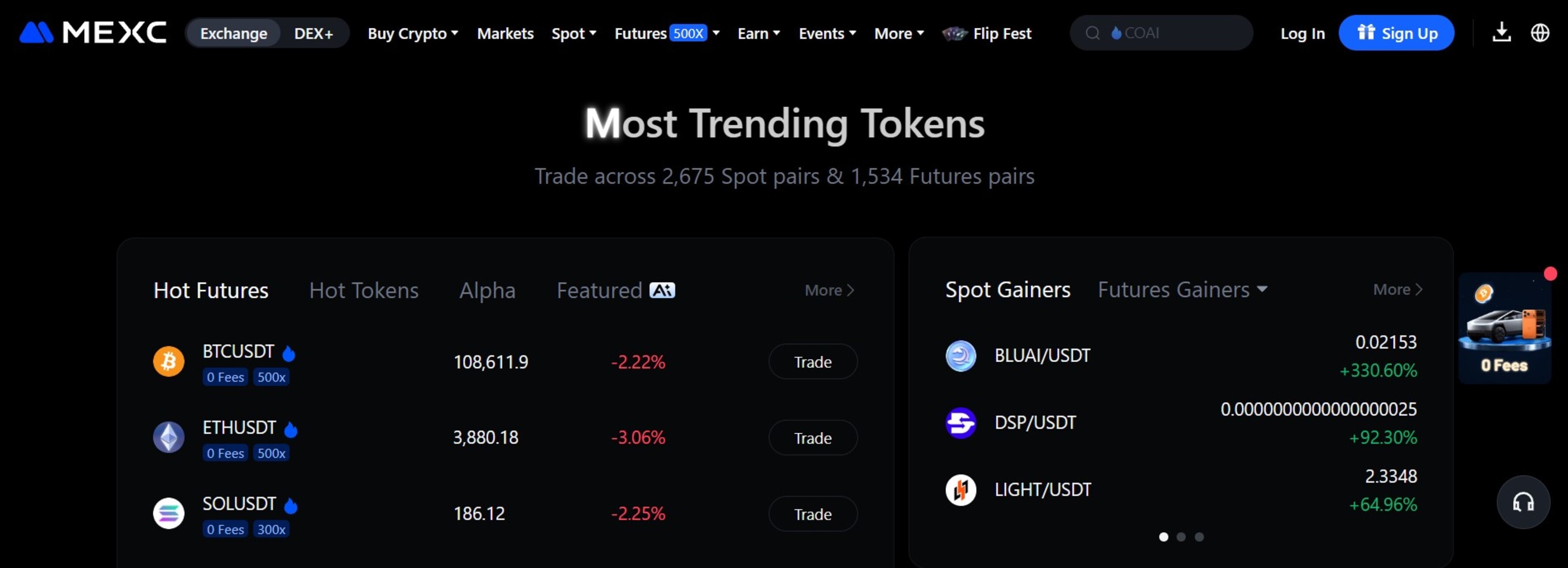

The crypto trading platform offers a wide range of products and services, including spot trading, futures, margin trading, copy trading, launchpad, demo trading, and staking. Investors on MEXC have access to over 3,000 coins and tradable assets. In addition to the already listed tokens, MEXC is often the first to list emerging tokens, allowing traders to invest before these projects are publicly traded.

Pros & Cons of MEXC

| Pros | Cons |

| Wide selection of cryptocurrencies (3,000+), including emerging tokens and lesser-known altcoins. | The interface can feel overwhelming due to the many in-app campaigns and reminders. |

| Lowest trading fees in the industry for both spot and futures markets, starting at 0%. | MEXC is restricted in some regions, including the United States. |

| The verification process is quick, allowing users to register with only an email and a password. | Mandatory KYC for new users |

| High leverage options | |

| Frequent token listings, campaigns, and promotional campaigns |

MEXC is Best for:

- Traders who are interested in exploring and investing in new/promising crypto projects.

- Lowest Fees: MEXC exchange offers one of the lowest fees in the crypto space. Transaction costs for spot and futures pairs start at 0%, making it perfect for frequent traders.

- Investors who want access to a wide variety of cryptocurrencies, including major coins and lesser-known altcoins.

- Futures and derivatives traders need high leverage of up to 500x and access to advanced trading tools.

If you are considering MEXC, discover the bonuses and exclusive discounts available to new traders who use a valid MEXC referral code to register.

What is Crypto.com?

Crypto.com is a trading platform founded in 2016 by Kris Marszalek, Rafael Melo, Bobby Bao, and Eric Anziani. The exchange provides a comprehensive range of financial services, including spot and derivatives trading, supporting over 350 cryptocurrencies with competitive fees.

Beyond trading, Crypto.com offers a range of products, including the Crypto.com Visa Card, which enables users to spend crypto for everyday purchases. The company also provides additional services for institutional traders and has expanded into decentralized finance (DeFi) with features such as staking, yield farming, and an NFT marketplace for digital collectibles.

The exchange places a strong emphasis on security, incorporating features such as cold storage, two-factor authentication, and regulatory compliance across multiple jurisdictions. It has over 100 million users globally and has become a well-known brand through major sponsorships, like the naming rights for the Crypto.com Arena in Los Angeles.

Pros & Cons of Crypto.com

| Pros | Cons |

| Its app and web platforms are designed for ease of use, attractive to both novices and experienced traders. | Limited fiat withdrawal methods for some regions |

| Multiple earning products are available, including Visa cards, staking, DeFi yield options, and an NFT marketplace. | Some users have reported slow or unresponsive customer service during high-volume periods. |

| Available in the US | Some services, including derivatives and advanced trading, are unavailable to New York residents and certain regions. |

| High-yield staking programs offering up to 19% APY on selected digital assets. | |

| Strong regulatory compliance worldwide |

Crypto.com is Best for:

- US traders Crypto.com is compliant with US crypto regulations, enabling residents to access all necessary tools for trading crypto and exploring decentralized applications in one place.

- Beginners who need a user-friendly interface and comprehensive educational resources to familiarize themselves with crypto trading and investing.

- Users seeking an all-in-one platform to trade crypto, stake tokens for profits, engage in DeFi yield farming, and more.

Before trading on Crypto.com, learn how to use the current Crypto.com referral code to earn massive bonuses.

MEXC vs Crypto.com: Trading Features

| Feature | MEXC | Crypto.com |

| Trading Options | Spot and perpetuals/futures contracts | Spot, derivatives, and options. |

| Leverage (futures/perpetuals) | Yes, 500x on major coins/pairs. | Yes, 50x on major pairs |

| Options Trading | ☓ | ✓ |

| Bots | ✓ | ✓ |

| Earn Products | ✓ | ✓ |

| Copy Trading | ✓ | Yes, “Whale Baskets” |

| Trial/Demo Trading | ✓ | ☓ |

| P2P | ✓ | ☓ |

| Launchpad | Yes, MEXC launchpad | No, but it does have a page where crypto projects can apply for listing on the exchange. |

MEXC vs Crypto.com: Platform Products and Services

Below is a breakdown of MEXC and Crypto.com’s products and services:

What MEXC Offers:

- DEX+: MEXC’s DEX+ is an integrated decentralized exchange aggregator that combines the benefits of DEXs with a user-friendly interface. It streamlines access to on-chain assets by removing the complexity often found in standalone DEX platforms.

- MEXC 0 Fees: MEXC offers zero fee pairs allowing users to trade spot and futures pairs without paying any transaction or maker-taker fees. With this, both new and active traders can profit since the exchange doesn’t charge for executing buy or sell orders. However, standard network or withdrawal fees still apply when you are transferring crypto assets to an external wallet.

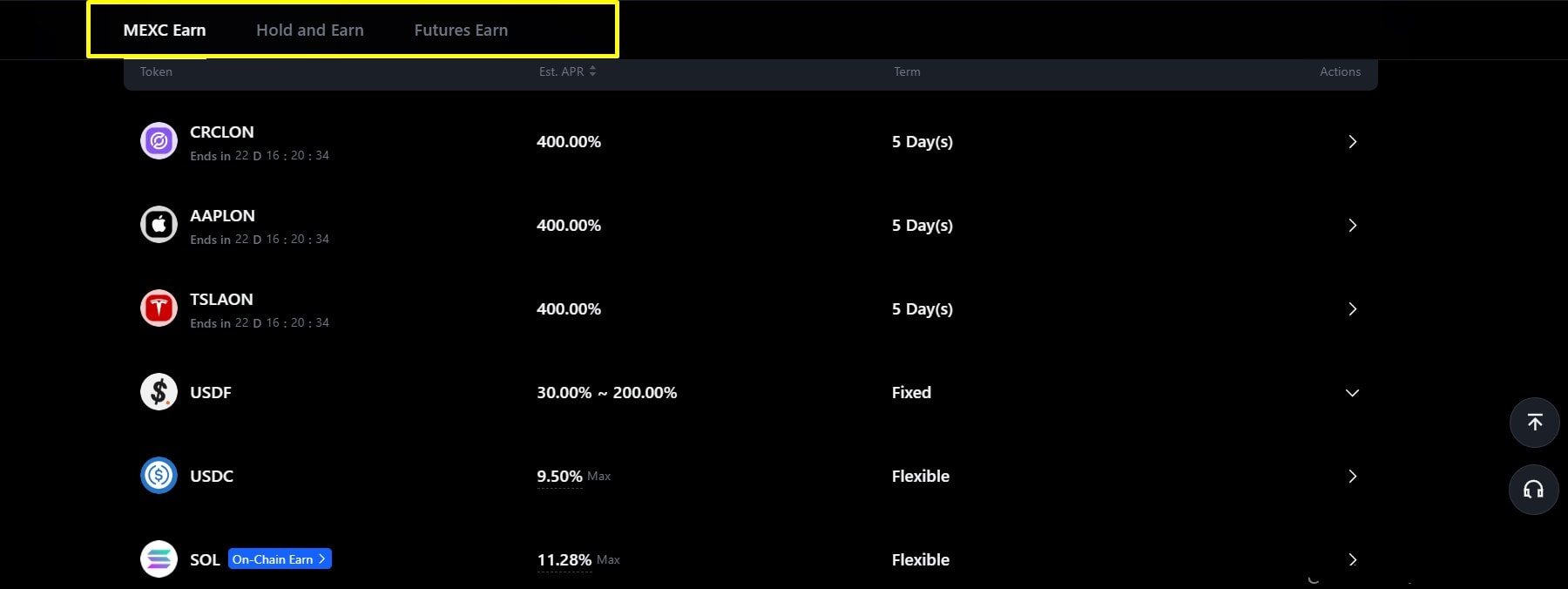

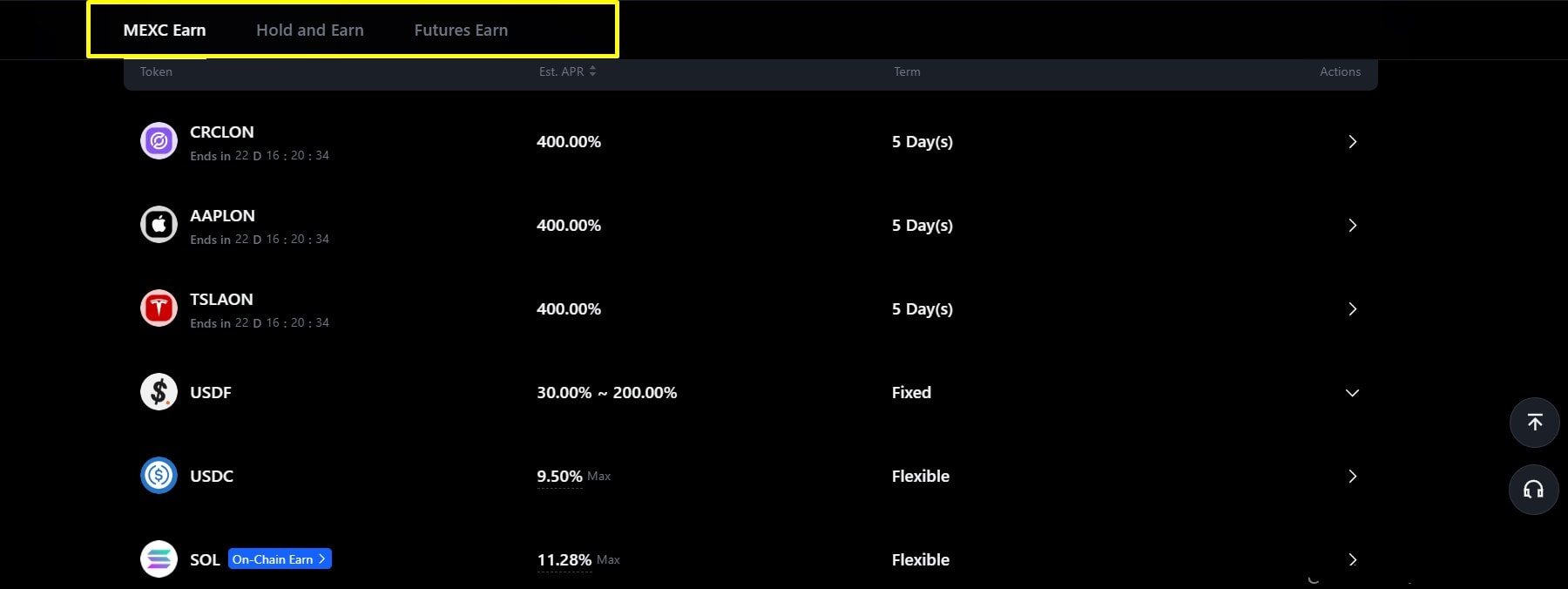

- MEXC Earn: MEXC offers users multiple channels to generate passive income. You can either use the locked or flexible savings products to earn money on your idle crypto or participate in campaigns like the Futures Earn. Another earning opportunity tied to futures contracts is the MEXC Futures M-Day, which is a special event series that allows users to earn new token rewards by trading futures or holding USDT.

What Crypto.com Offers:

- Crypto.com On-chain: Crypto.com offers on-chain services that give users direct access to blockchain transactions and decentralized ecosystems through its DeFi Wallet. This enables secure self-custody, token swaps, and participation in various DeFi protocols, while maintaining full control of private keys.

- Automated Trading Tools: For active traders, Crypto.com offers bots and algorithmic trading tools, including Grid Trading, DCA (Dollar-Cost Averaging), and Recurring Buy bots. These tools help users automate trades, manage risk, and capitalize on market movements efficiently.

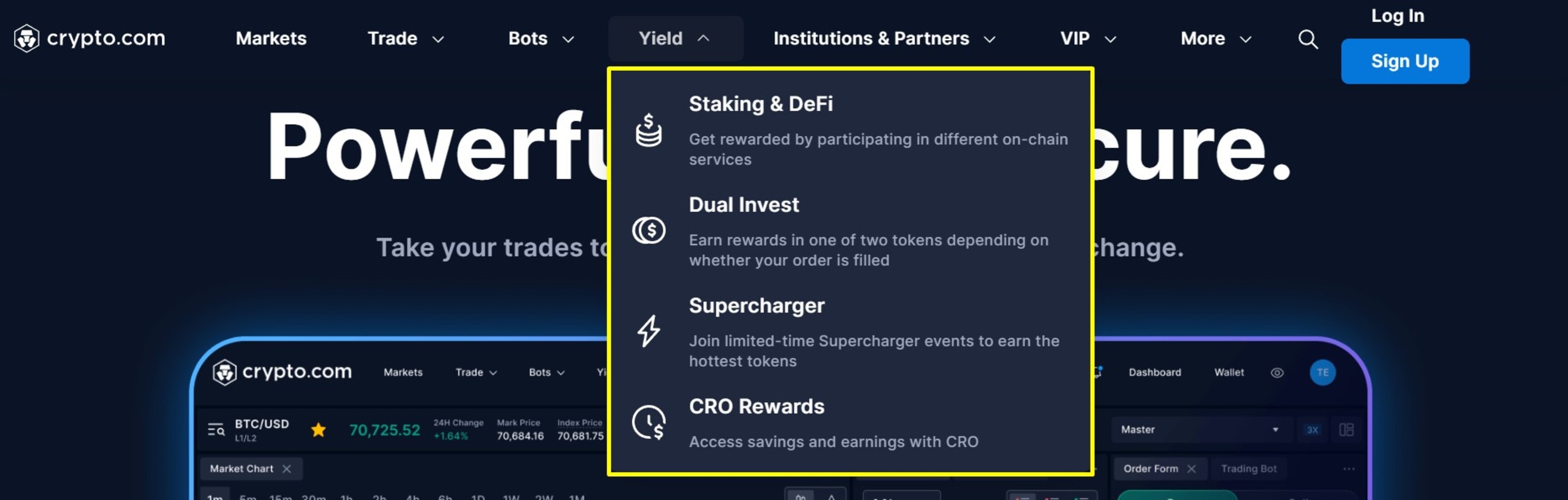

- Crypto.com Yield: Crypto.com offers multiple avenues for passive income through its Crypto Earn suite, featuring Staking & DeFi, Dual Invest, Supercharger, and CRO Rewards.

- Staking & DeFi enable users to lock up cryptocurrency or participate in decentralized protocols, earning interest.

- Dual Invest enables users to invest in paired digital assets (such as BTC/USDT) for fixed returns based on market outcomes.

- Supercharger gives users the chance to earn new project tokens by staking CRO for a limited time.

- CRO Rewards provide cashback and bonuses for using the Crypto.com Visa Card and other ecosystem products.

MEXC vs Crypto.com: Fee Structures

| Transaction Fee | MEXC Global | Crypto.com |

| Spot (maker/taker) | 0.0000%, 0.0500% | 0.250% and 0.500% |

| Futures (maker/taker) | 0.000%, 0.020% | 0.020% and 0.040% |

| Trading Fee Discounts | 50% discount available for MX token holders. | A 3% maker fee and a 12% discount on taker fees are available for CRO holders. |

| Deposit Fees | Free | Free |

| Withdrawal Fees | Fees depend on the token you are withdrawing and the chain.

|

Fees also depend on the token you are withdrawing and the chain. |

| Zero Fee Pairs | Yes | Yes |

MEXC vs Crypto.com: Coins Supported, Liquidity & Volume

| Criteria | MEXC | Crypto.com |

| Supported Cryptocurrencies | 3,000+

|

400+ |

| Trading Pairs | 2,000+ pairs

|

600+ |

| Market Liquidity | Deep | Deep |

| Daily Trading Volume | High (placing it among the top 10 exchanges by volume)

|

High (among the top 10 exchanges by volume) |

MEXC vs Crypto.com: Security Comparison

MEXC Security Measures

- Account Security: User account security features include two-factor authentication (2FA), strong passwords, withdrawal address whitelisting, and enable IP restrictions. The platform also routinely applies real-time risk control and anti-fraud systems, including AI-driven monitoring of suspicious behaviour and compliance checks.

- Cold Storage: MEXC stores about 95% of user funds in offline cold wallets, which are not susceptible to online threats.

- Insurance Fund: MEXC launched a $100 million “Guardian Fund,” which is set aside to compensate users whose wallets and balances are affected by major security breaches. The exchange also has a $500+ million futures insurance fund that is used to cover losses when a user’s liquidation exceeds their margin.

Crypto.com Security Measures

- Cold/Offline Storage: The platform stores 100% of investors’ crypto assets in offline wallets, which are offline and insulated from hacking attempts. Hot wallets only hold operational funds, and withdrawals are reimbursed from cold storage, ensuring customer protection even if hot wallets are compromised.

- $750 Million Insurance Coverage: The crypto exchange benefits from a $750 million cold-storage insurance policy, which is one of the largest in the crypto space. This coverage is supplemented by an additional $120 million insurance for institutional custody covering crime and physical asset loss.

- Multi-Factor Authentication (MFA): Beyond standard two-factor authentication (2FA), Crypto.com is transitioning to multi-factor authentication to increase resilience against phishing and account takeovers. Authentication is required for login, withdrawals, password changes, and API key activation.

MEXC vs Crypto.com: Affiliate & Referral Programs

| Criteria | MEXC Global | Crypto.com |

| Referral Bonus (Sign up) | 10,000 USDT | Up to 1 BTC (Bitcoin) |

| Fee Rebate | 50% | 50% |

| Affiliate Commissions | 70% on your referrals’ trading fees | 50% |

| Extra Perks | Additional 10% commission for sub-affiliates. | Performance-based bonuses for achieving milestones.

Earn up to $2,000 worth of CRO for each friend successfully referred. |

| Affiliate Payout | Daily | Instantly (as soon as conditions are met). |

| Current Referral ID | mexc-NFTP | nftevening |

| KYC Requirement | Mandatory | Mandatory |

MEXC vs Crypto.com: User Experience

MEXC offers a more exchange-focused trading interface, perfect for intermediate and advanced mobile and desktop traders. From our MEXC review, the trading interface enables users to customize their trades and track crypto price movements effectively using real-time order books, advanced charting tools, and multiple technical indicators.

MEXC has a quick onboarding process, although it now requires KYC for new users. Additionally, the exchange provides a smooth experience, with orders fulfilled with minimal slippage due to its high liquidity and fast trade execution, which is optimized for active traders. However, the UI can feel overwhelming for beginners due to multiple promotional materials and campaigns.

Moving on to the findings from our Crypto.com review, the exchange offers a sleek, polished, and intuitive interface across its mobile app and web platform, designed for both beginners and experienced traders. Crypto.com integrates trading, staking, DeFi, an NFT marketplace, and crypto Visa cards in one app, allowing traders to easily multitask without switching platforms.

The registration and KYC process is straightforward, although some users complain about verification delays and having to resubmit documents. Once you get past the identity verification process, the platform is stable, with fast execution speeds and generally minimal downtime.

MEXC vs Crypto.com: Customer Support

MEXC offers 24/7 support through live chat, email, ticket submissions, and an extensive Help Center, with many users praising the company’s fast live chat response times. However, user feedback is mixed regarding handling serious issues. Little wonder why the Trustpilot score for MEXC’s support is low (1.8/5) based on 1,000+ reviews. Many users report experiencing long wait times and receiving generic responses when seeking assistance with frozen accounts and withdrawal delays.

On the other hand, Crypto.com offers 24/7 support primarily through live chat, along with email assistance. Crypto.com support is generally responsive and beginner-friendly, with an extensive help center featuring detailed guides and FAQs. Still, many users complain of long wait times, generic replies, and the inability to reach a human agent. Hence, the exchange’s rating on Trustpilot is low (around 1.3 from 9,000+ reviews), largely due to support issues.

Conclusion: Which Is the Better Cryptocurrency Exchange?

With hundreds of crypto exchanges available for trading and most, including MEXC and Crypto.com, offering similar products, deciding on the best one can be challenging. However, our comprehensive MEXC vs Crypto.com comparison gives you a round-up of what to expect from both exchanges.

Choose MEXC for comprehensive trading tools and to explore trending projects. If you are in the US or need an all-in-one platform for trading and exploring other DeFi protocols, opt for Crypto.com. Ultimately, do proper research before you begin trading on any cryptocurrency exchange.

FAQs

Is MEXC a Reliable Crypto Exchange?

MEXC is a reliable exchange. Hacken conducted a full security audit of MEXC, which found no critical or high-risk vulnerabilities in its mobile app. Additionally, the cryptocurrency exchange has strong security measures in place to safeguard users’ assets.

What are the Key Differences Between Crypto.com and MEXC?

The key differences between Crypto.com and MEXC are platform focus, regulatory compliance, and user experience. Crypto.com is an all-in-one crypto ecosystem offering spot and derivatives trading, DeFi yield, an NFT marketplace, and a crypto Visa card. Meanwhile, MEXC provides a broader range of exchange services, including spot, futures, margin, P2P trading, and leveraged tokens.

In terms of regulatory oversight, Crypto.com is licensed in over 90 countries, including key markets like the US, EU, UK, Abu Dhabi, and Singapore. In contrast, MEXC is blocked in the US and is not FCA authorized in the UK, limiting its presence in some major regulated markets.

Which Exchange has Lower Fees: MEXC vs Crypto.com?

MEXC has lower trading fees than Crypto.com. Although both crypto exchanges offer zero-fee trading on some select trading pairs, MEXC’s standard fees are much lower, starting at 0%.

Which Exchange is More Beginner-friendly: MEXC or Crypto.com?

Crypto.com is more beginner-friendly than MEXC, thanks to its polished interface, simpler trade flows, and neatly placed products/services (cards, payments, earn products).

Are MEXC and Crypto.com Safe and Legal to Use?

Yes, MEXC and Crypto.com are safe and legal to use, provided you are not accessing these cryptocurrency exchanges from a restricted country/region.

What are the Deposit and Withdrawal Options on MEXC vs Crypto.com?

Crypto.com offers crypto deposits, withdrawals, and wider fiat on/off-ramp options. Available fiat methods include bank transfers (ACH, SEPA, Faster Payments), credit/debit cards, and payment apps. Meanwhile, MEXC also offers crypto deposits and withdrawals. The exchange offers limited fiat on/off-ramp options, including credit/debit cards, SEPA bank transfers, and third-party providers.