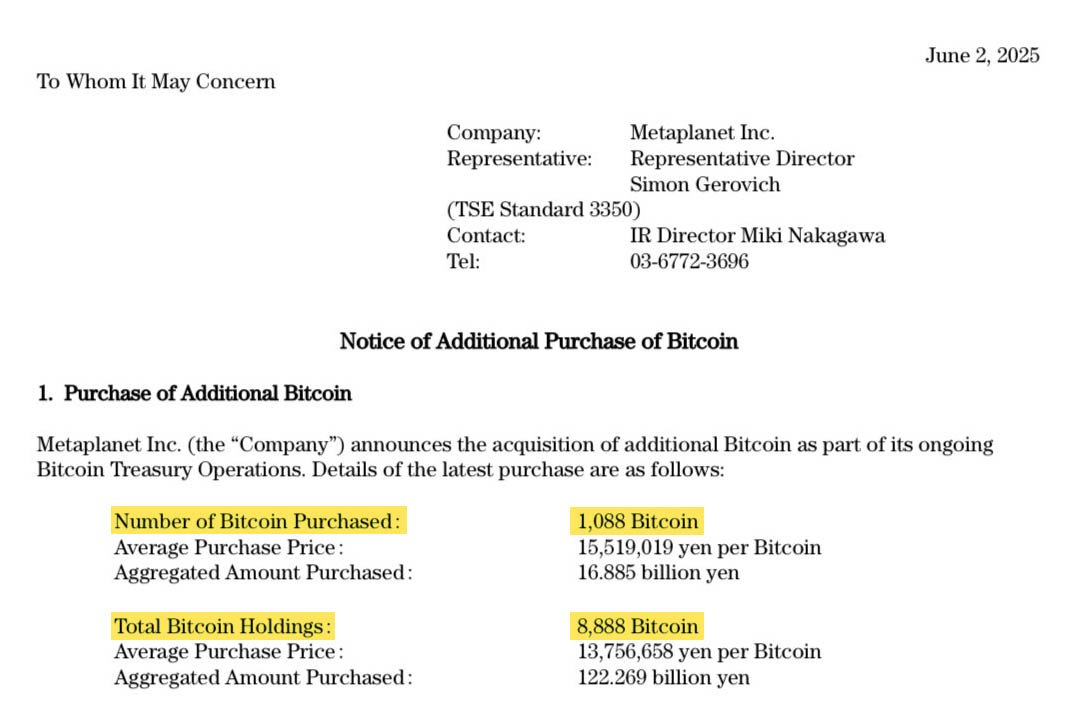

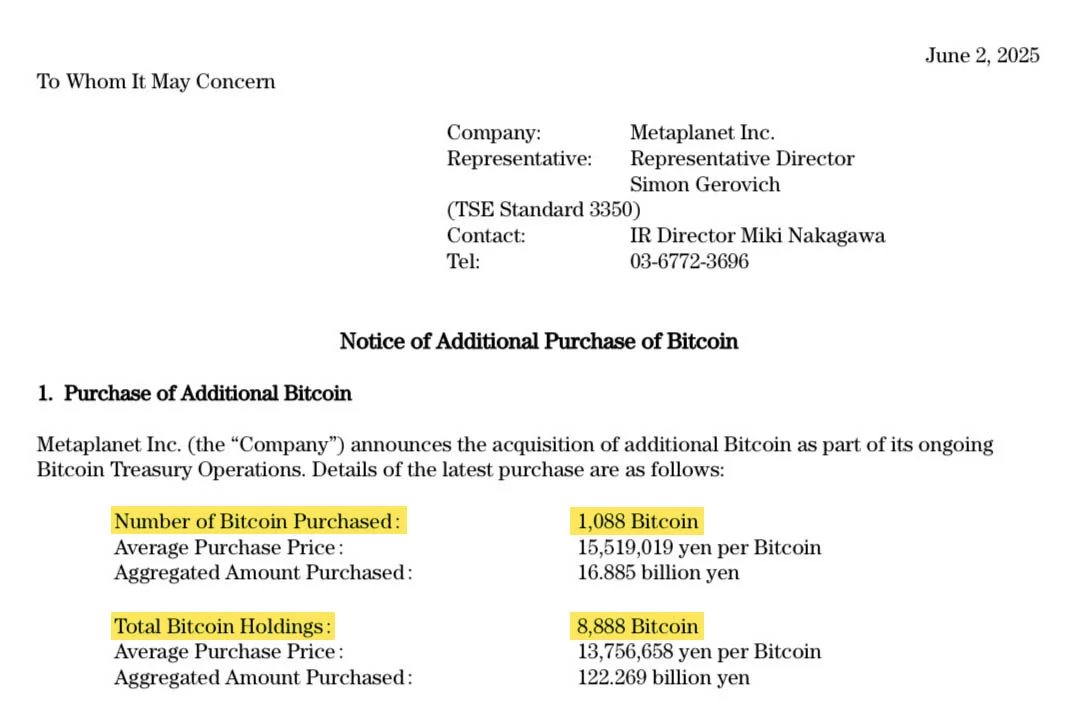

Metaplanet Inc. has bought 1,088 more bitcoin (BTC), and now holds 8,888 BTC worth over $930 million. This puts Metaplanet in the top 10 corporate bitcoin holders, ahead of Galaxy Digital and Block Inc.

The company’s CEO Simon Gerovich announced the purchase on X on June 2, 2025. The company bought the new BTC at an average price of around $107,771 per coin, costing the company approximately $117.3 million.

The company said this purchase brings them 90% of the way to their 2025 goal of 10,000 BTC.

Metaplanet only started its bitcoin treasury policy in April 2024 but has been moving fast. At the start of 2025, it had less than 2,000 BTC, and now it has over 8,800.

This has been done through a combination of stock rights exercises and bond issuances, raising capital without diluting existing shareholders. In May 2025 alone, Metaplanet issued zero-coupon, non-interest-bearing bonds for a combined value of $71 million.

According to the filings, the company recently completed its “21 Million Plan” which was a program that involved the full exercise of 210 million stock acquisition rights.

These stock rights allowed Metaplanet to raise capital through equity sales while limiting dilution risk.

Metaplanet’s Bitcoin strategist, Dylan LeClair, said the company views bitcoin as a core part of its financial strategy and is all in, not just making small allocations.

Metaplanet’s buying has paid off in more ways than one.

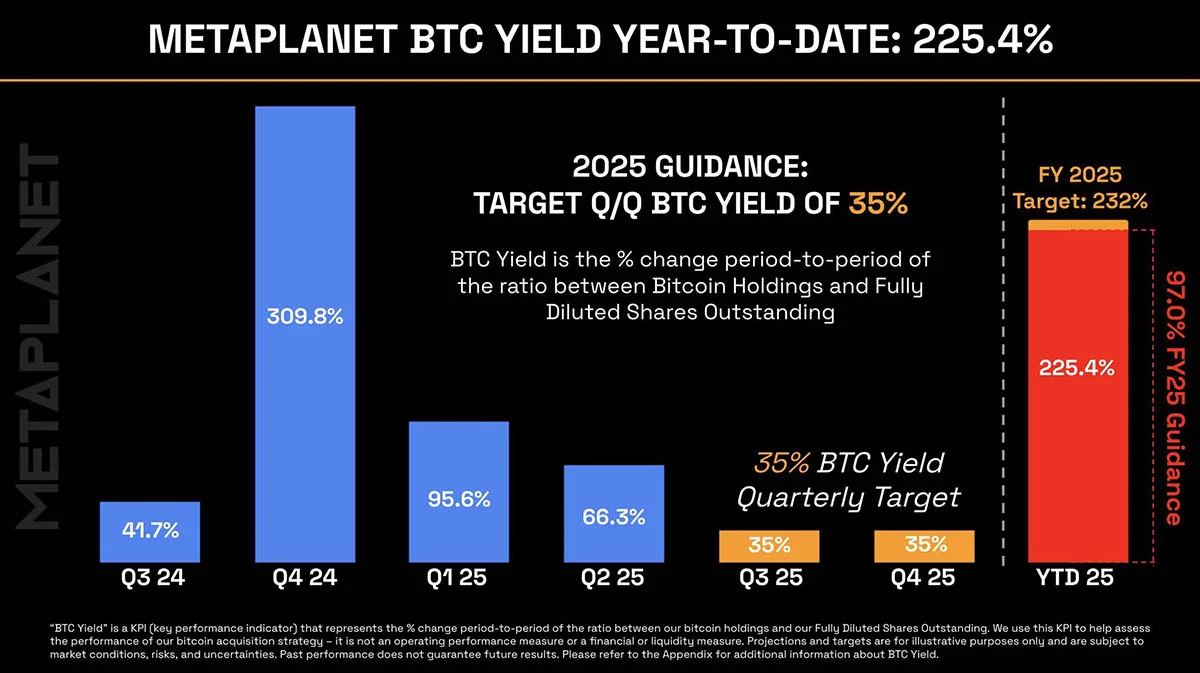

Its BTC Yield, a company metric that compares bitcoin holdings to total shares, has impressed investors. In Q2 2025 it had a 66.3% BTC Yield, year-to-date it has a 225% BTC Yield.

The stock is up 155% in the last month and is currently trading at 1,149 JPY, despite the overall volatility in the Tokyo Stock Exchange—where many other companies are under pressure due to the rising Japanese bond yields.

Analysts say the company still has more room to run.

Analysts say the company’s mNAV is back to 4.75 and the stock is undervalued compared to Strategy.

mNAV is short for “multiple of Net Asset Value” and is a metric used to compare the market’s valuation of a company to the actual value of its assets, primarily its bitcoin holdings.

Metaplanet is called “Japan’s Strategy”, a reference to Michael Saylor’s Strategy, the U.S.-based company that holds over 580,000 BTC—the most of any company in the world.

The corporate bitcoin boom isn’t stopping with Strategy and Metaplanet. On May 28, 2025 GameStop announced it had bought 4,710 BTC, worth over $512 million, its first foray into bitcoin after updating its investment policy this year.