Bitcoin price jumped today after a strange moment for markets. The Federal Reserve found itself at the center of a political storm, and the US dollar immediately felt the pressure. Comments from Fed Chair Jerome Powell about a possible criminal probe tied to the central bank’s headquarters renovation sent us scrambling to reassess risk.

And boy, just how quickly confidence shifted. The Federal Reserve looked vulnerable, the US dollar softened, and investors leaned into assets that sit outside direct political reach. In this setting, Bitcoin didn’t hesitate, pushing its price higher as uncertainty took place.

The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President”

Federal Reserve in Trouble? Will Bitcoin Price Run Continue?

Powell said the threat of charges stems from the Federal Reserve choosing policy based on economic data, not presidential preference. Markets took that explanation at face value. The US dollar slid to around 0.2%, pulling the dollar index toward 99, while the Bitcoin price ran to above $92,000.

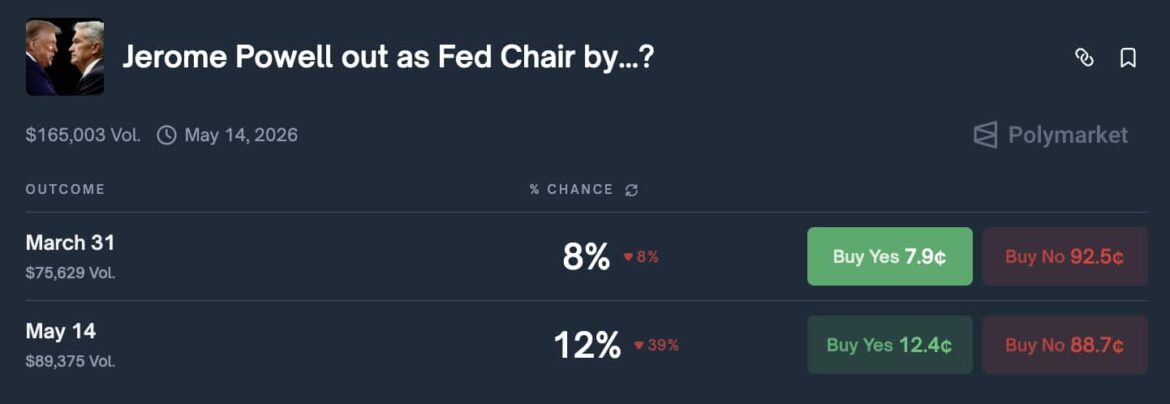

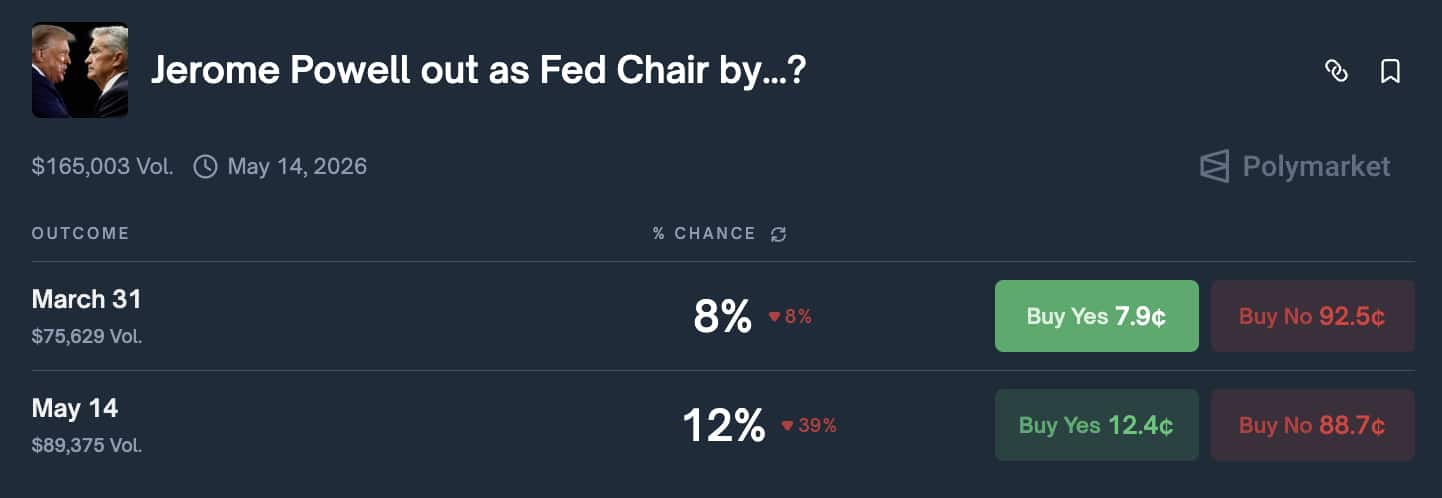

Political pressure on the Federal Reserve has been building for some time. It is known that President Trump has repeatedly argued for lower rates and faster money creation, and with talk growing around a possible leadership change at the Fed later this year, we are beginning to price in instability. Betting markets now show about a 20% chance of Jerome Powell being out as Federal Reserve chair by March.

(source – Polymarket)

From a chart perspective, Bitcoin price spent most of last week moving sideways between $90,000 and $91,000, with the exception of a superb run to $94,000 on the 6th of January. Buyers have been stepping in consistently, and today’s break above $92,000 confirmed a technical breakout. Momentum indicators, including an RSI near 60, show that the move still has room without looking stretched. And yeah, Michael Saylor’s Strategy is still buying.

₿ig Orange. pic.twitter.com/VmFz8nI1uq

— Michael Saylor (@saylor) January 11, 2026

DISCOVER: 10+ Next Crypto to 100X In 2026

Liquidity, FED’s Policy, and The Weakening of the US Dollar to Shape Markets?

Away from the headlines, liquidity remains a powerful force. Global liquidity is sitting at record highs as the Federal Reserve continues Treasury bill purchases and quietly expands its balance sheet. Additional stimulus measures, including large mortgage bond programs, have only added pressure on the US dollar.

Global Liquidity is skyrocketing.

Bitcoin will follow! pic.twitter.com/oQOsajXbss

— Mister Crypto (@misterrcrypto) January 11, 2026

Regulatory tone has also shifted. Progress toward clearer crypto rules and expectations of future Federal Reserve rate cuts have helped support sentiment. As the US dollar loses ground, Bitcoin is increasingly viewed as a practical alternative, and the price will follow.

Altcoins still followed Bitcoin’s move, though unevenly. Ethereum hovered at $3,200, while Solana pushed above $140. Although the market is still, at the moment, focused firmly on the Bitcoin price, which, like it or not, mirrors investor confidence.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Hyperliquid HYPE Grabs +69% of Perp Traders as Rivals Fade

Crypto assets are volatile, which means opportunities for those who are ready. After years of centralized exchange (CEX) dominance led by Binance and Coinbase, the trading scene is changing fast. Less than three years after launching, Hyperliquid is giving Binance and top CEXs a run for their money.

Recent on-chain data shows that Hyperliquid now controls about +69% of all daily active users trading perpetual futures on decentralized exchanges (DEXes).

HYPERLIQUID CONTROLS 69% OF PERP DAILY ACTIVE USERS

Hyperliquid now accounts for 69% of all daily active users trading perpetual futures, underscoring its dominant position in the onchain derivatives market and growing trader migration toward its platform. pic.twitter.com/LVKUXblBBI

— Crypto Town Hall (@Crypto_TownHall) January 12, 2026

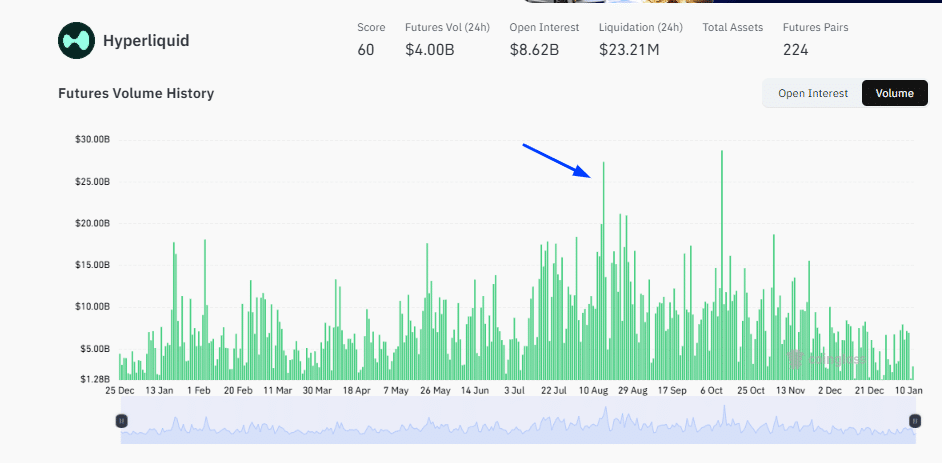

That dominance shows up in volume too, with daily trading volume pushing past $27Bn on August 15.

(Source: Coinglass)

The shift fits a wider DeFi trend where traders chase speed, tight spreads, and familiar tools. As the scene shifts, HYPE, the native token of Hyperliquid, is also riding the wave. At spot rates,

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

2.64%

Hyperliquid

HYPE8

Price

$24.96

2.64% /24h

Volume in 24h

$88.10M

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

crypto is steady, hovering around $25, up nearly +3% in the last 24 hours.

Read the full story here.

The post Crypto Market News Today, January 12: Bitcoin Price Run as Powell Said DOJ Threatens the Federal Reserve, US Dollar Weakens appeared first on 99Bitcoins.