Cetus Protocol, a number one DEX on the Sui Community, has been hacked, dropping a minimum of $200 million. CETUS, SUI, and Sui community meme cash crashed because of this. Right here’s all the things it’s worthwhile to know concerning the Cetus Protocol hack.

There’s at all times a primary for all the things. Ethereum confronted a tough fork barely a yr after launching. Whereas not a hack, the harm and controversy impacted Ethereum, inflicting splits in blockchain ideology.

Cetus Protocol Hacked

Launched in Might 2023, the Sui Community loved a clean run till right this moment, when the Cetus Protocol fell sufferer to hackers.

Cetus(@CetusProtocol) on #SUI was hacked and misplaced greater than $260M!

The hacker is changing the stolen funds into $USDC and cross-chaining to #Ethereum to alternate for $ETH, with ~60M $USDC already cross-chained.https://t.co/b0uGu8icXrhttps://t.co/0BpKSaygmr pic.twitter.com/txfxLoImOd

— Lookonchain (@lookonchain) May 22, 2025

The protocol misplaced between $220 and $230 million in an incident that despatched shockwaves by way of the crypto and DeFi communities.

Hacks not solely consequence within the lack of valuables, knowledge, and funds but in addition have extreme unwanted side effects, generally even forcing sell-offs in among the best cryptos to buy.

The Cetus Protocol hack triggered a sell-off, inflicting CETUS to plummet by over 40% and path among the best Solana meme coins.

What’s Cetus Protocol?

So, what occurred? The Cetus Protocol is a decentralized alternate (DEX) on the Sui Community.

It makes use of the concentrated liquidity market maker (CLMM) mannequin pioneered by Uniswap and incorporates options from Dealer Joe’s CLMM design.

Past token swapping, Cetus is likely one of the largest liquidity suppliers on Sui.

Inside the Sui ecosystem, customers primarily use Cetus to swap SUI/USDC, however as a DEX, it helps tons of of liquidity swimming pools for varied tokens minted on the community.

Over time, Cetus turned a hub for buying and selling meme cash on the scalable platform.

What Occurred?

As a core DEX on Sui, Cetus was (as anticipated) a chief goal for hackers.

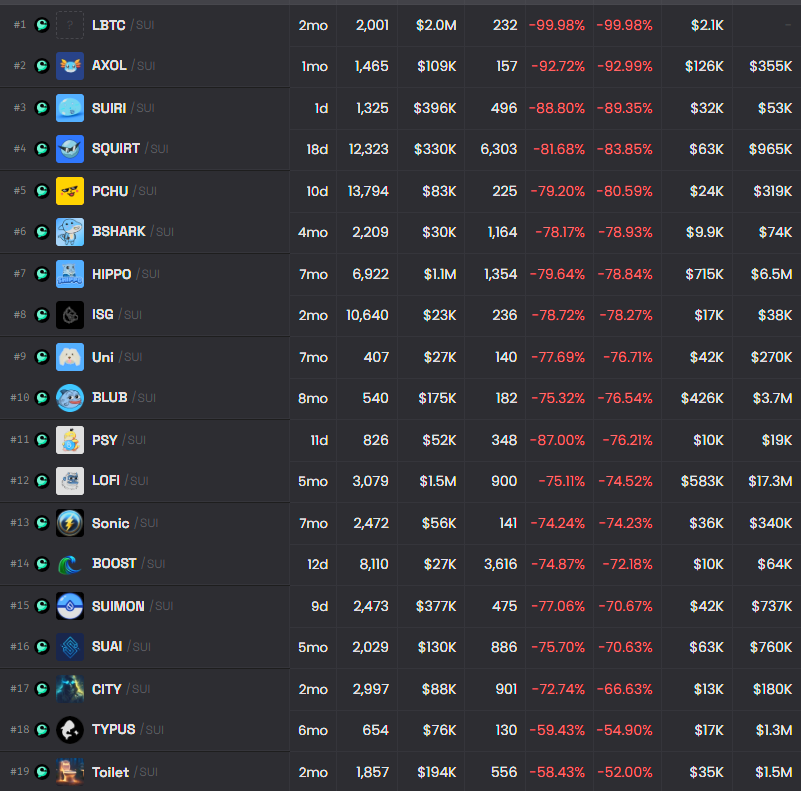

On Might 22, they exploited a number of liquidity swimming pools, draining $11 million from the SUI/USDC pool and wiping out funds from varied meme coin swimming pools, inflicting token costs to crash.

(Source)

The Lombard Staked BTC (LBTC) pool was among the many hardest hit, practically worn out solely.

How did this Cetus Protocol hack occur?

Analysts report that hackers gained management of all SUI-denominated liquidity swimming pools.

They then minted or deposited near-zero-value spoof tokens to govern CLMM worth curves and reserves, extracting actual property with out depositing equal worth.

Looks as if all @CetusProtocol LP had been drained

Wanting into tx, the doubtless exploit path was:

1. Swap in spoof token (e.g. BULLA → SUI), profiting from miscalculated worth curve or damaged reserve math.2. Add liquidity with a near-zero quantity, to govern inner LP… pic.twitter.com/FtpYRSpwWW

— sashko

(@d0rsky) May 22, 2025

This was attainable because of a rounding bug within the liquidity pool logic.

How @CetusProtocol was hacked

A hacker abused a rounding bug within the liquidity pool logic.

The bug?

Cetus miscalculated LP share:

For those who added 1 token, it generally gave you the share as should you added 2.

Sounds silly, but it surely labored.

The exploit:

Flashloan… pic.twitter.com/Ibj3uf8KJG

— Sui Nook (@SuiCorner) May 22, 2025

Though the Oracle was anticipated to detect this, Cetus attributed the exploit to a pricing Oracle malfunction.

By then, hackers had stolen tokens value over $200 million.

Roughly $60 million in USDC was rapidly bridged to Ethereum and swapped for ETH inside an hour.

However there’s excellent news: Round $160 million has reportedly been frozen and might be returned to Cetus swimming pools.

ANNOUNCEMENT

As of earlier right this moment, we’ve got confirmed that an attacker has stolen roughly $223M from Cetus Protocol. Now we have took quick motion to lock our contract stopping additional theft of funds.

$162M of the compromised funds have been efficiently paused. We’re…

— Cetus

(@CetusProtocol) May 22, 2025

Injury Management Underway at SUI

As token costs plummeted, Cetus Protocol froze its contracts to halt additional losses.

It additionally promised a radical investigation.

Sui Community builders have pledged help.

We’ve discovered {that a} Cetus good contract was hacked this morning for roughly $223M and Cetus subsequently paused their good contracts to forestall additional theft.

Cetus labored along with the opposite DeFi protocols, the Sui Basis, and the Sui validators to… https://t.co/Y1iw2sNnPW

— Sui (@SuiNetwork) May 22, 2025

Amid the chaos, Changpeng Zhao, the Binance co-founder, stated they’d “do all the things” to assist Sui, noting that the hack is “not a pleasing state of affairs.”

DISCOVER: Next 1000x Crypto – 11 Coins That Could 1000x in 2025

Cetus Protocol Hack, CETUS And SUI Costs Crash

- Cetus Protocol hacked, loses over $230 million

- Hackers focused SUI-denominated liquidity swimming pools

- CETUS and SUI costs drop

- Group and group investigating the incident, $160 million reportedly recovered

The publish Cetus Protocol on Sui Network Hacked and Prices Tank: Everything You Need To Know appeared first on 99Bitcoins.