It feels like the sky is falling again, doesn’t it? If you’ve been watching the charts lately, you’ve seen the Bitcoin price slide aggressively in 2026, testing the nerves of even the most seasoned veterans. We are currently staring down a drop toward the $60,000 range, a far cry from the euphoria of the $100,000 highs we saw not long ago.

But according to industry experts, this isn’t a catastrophic crash; it’s a stress test. Anthony Pompliano, founder of Professional Capital Management, recently described this pullback not as a sudden heart attack, but as “death by a thousand cuts.” It sounds painful, but for those employing a long-term strategy, this might just be the most important buying opportunity of 2026.

The macro environment is important for bitcoin investors to understand now.

Wall Street is here, so you have to pay attention to what they are thinking and doing. pic.twitter.com/OJJhoX479l

— Anthony Pompliano

(@APompliano) February 13, 2026

Why This Bitcoin Price Volatility Matters for Investors

So, why is the market bleeding? Speaking on CNBC, Pompliano highlighted that there isn’t one single villain in this story. Instead, it’s a mix of four smaller factors. First, we have natural profit-taking after Bitcoin finally smashed the psychological $100,000 barrier in a typical cyclical fashion. Second, investors now have “more at the buffet” with the rise of AI stocks, which are stealing some of crypto’s spotlight, alongside the explosive new all-time highs for gold.

Crucially, the narrative is shifting. While many of us bought Bitcoin as an inflation hedge (protection against the dollar losing value), Pompliano argues that deflation is now the bigger economic risk. This shift causes short-term confusion in the market.

However, he notes that Bitcoin volatility is actually compressing as the asset matures. He calls it an “80-volt asset turning into a 40-volt asset.” Basically, the price swings are getting smaller over time, even if they still feel like a rollercoaster ride to us.

Currently, however, crypto market sentiment has hit rock bottom. We are seeing Crypto Fear and Greed at a 6-year low, suggesting panic is the dominant emotion right now.

Crypto Fear and Greed Chart

1y

1m

1w

24h

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

What the Data Actually Shows About Bitcoin Price Slide in 2026

The numbers back up the “death by a thousand cuts” theory. We aren’t seeing a structural failure of the Bitcoin network; we are seeing market mechanics at work. The introduction of ETFs has “financialized” Bitcoin, meaning it now trades more like a traditional asset and less like the wild west currency it used to be.

This recent slide is largely a “deleveraging without capitulation” claim, according to VanEck. Explained in plain English? Traders using borrowed money (leverage) are getting washed out, but long-term believers aren’t selling.

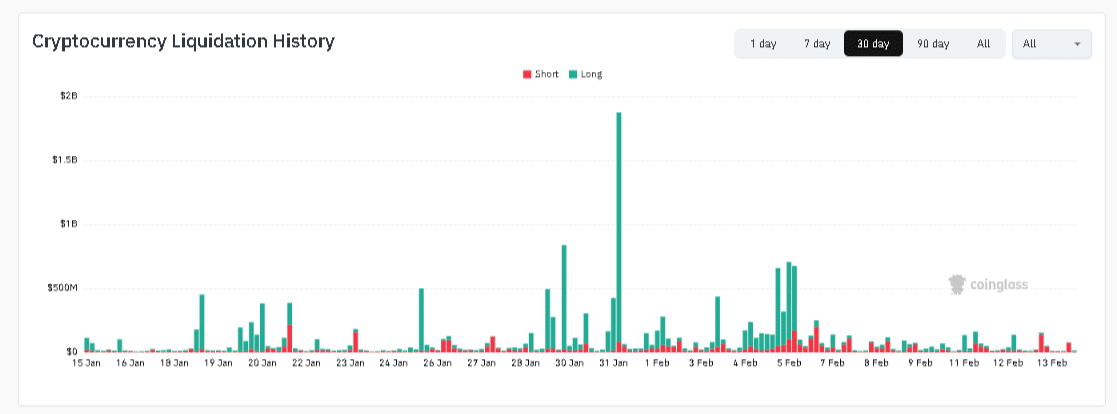

(Source – Crypto Liquidations, CoinGlass)

Data from Coinglass shows billions in liquidations, contributing to the panic selling that has accelerated in recent weeks. Yet, Pompliano points out that relative to previous bear markets, this cycle has seen the smallest drawdowns from the peak. The floor is rising, even if it feels like the floor is dropping out from under you today.

DISCOVER: Top 20 Crypto to Buy in 2026

Is ‘Extreme Fear’ Actually a Buy Signal For Bitcoin Price?

For beginners, this is the hardest part: doing the opposite of what your gut tells you. When everyone else is terrified, the contrarian move is to look for opportunity. This is where the HODL strategy (Holding On for Dear Life) is truly tested.

Historically, buying Bitcoin when the Fear & Greed Index is in “Extreme Fear” (below 20) has often led to significant returns a year later. It’s why major analysts are still maintaining high targets. For instance, we still see forecast models like Bernstein’s Bitcoin price target of $150k in play despite the current gloom.

In fact, while retail investors are panic-selling, on-chain data suggests institutions are buying the dip through ETFs. As Kraken’s market outlook notes, volatility is the price you pay for performance.

What to Watch Next: Keep an eye on the $60,000 level and Fed announcements on interest rates. The market is fearful, but that’s exactly when the savvy investors start paying attention.

DISCOVER: How to Buy Bitcoin for Beginners

Follow 99Bitcoins on X (Twitter) and YouTube for daily updates.

The post Bitcoin’s Death by a Thousand Cuts: Why Current Volatility is the Ultimate HODLer Test appeared first on 99Bitcoins.