Bitcoin ETFs recorded $1.33 billion in net outflows during the week ending January 23 and had the second-largest weekly redemption on record.

Summary

- Bitcoin ETFs saw $1.33B in outflows, the second-largest weekly redemption on record.

- Ethereum ETFs followed with $611M in withdrawals, led by BlackRock’s ETHA.

- Solana ETFs stayed positive with inflows, while XRP saw its first weekly outflow.

The exodus reversed the previous week’s $1.42 billion inflow, as institutional investors reduced crypto exposure amid market volatility.

Ethereum spot ETFs followed with $611.17 million in weekly outflows, led by BlackRock’s ETHA which posted $432 million in redemptions. XRP spot ETFs recorded their first weekly outflow since launch at $40.64 million, ending a streak of positive flows.

Solana spot ETFs bucked the trend with $9.57 million in weekly inflows, providing the only bright spot across major crypto ETF products.

Bitcoin ETFs posts four consecutive days of outflows

The January 20-23 period saw continuous selling pressure across Bitcoin ETFs. Monday posted $483.38 million in outflows, followed by the week’s largest single-day exodus of $708.71 million on Tuesday.

Wednesday brought $32.11 million in redemptions, while Thursday closed with $103.57 million in withdrawals.

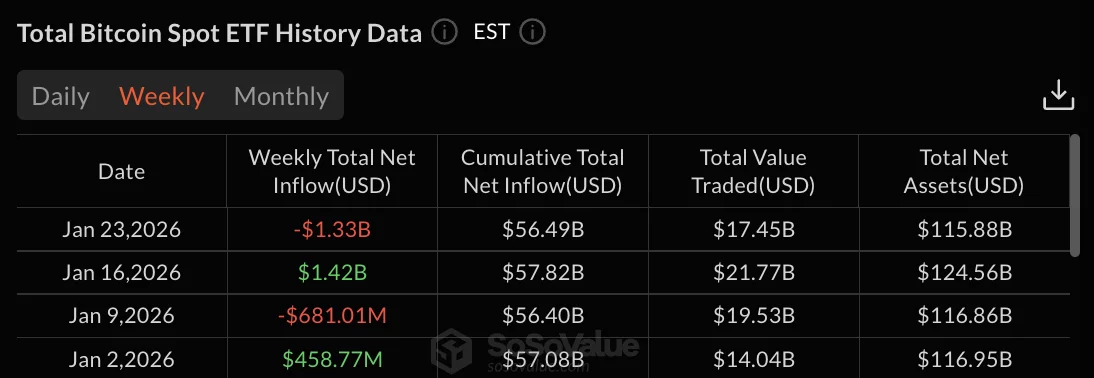

Total net assets under management fell to $115.88 billion on January 23 from $124.56 billion on January 16.

Cumulative total net inflow dropped to $56.49 billion from $57.82 billion over the same period. Total value traded for the week reached $17.45 billion.

The reversal came just one week after Bitcoin ETFs attracted strong institutional buying. The week ending January 16 brought $1.42 billion in inflows across four consecutive positive days, with January 14 marking the strongest single-day performance at $843.62 million.

Weekly data shows Bitcoin ETFs alternating between inflows and outflows throughout January. The week ending January 2 posted $458.77 million in inflows, followed by $681.01 million in outflows the week ending January 9.

Ethereum bleeds $611M as BlackRock leads redemptions

Ethereum’s weekly outflows totaled $611.17 million, reversing the previous week’s $479.04 million in inflows.

BlackRock’s ETHA accounted for 71% of redemptions at $432 million, while other funds contributed the remaining $179 million.

Daily outflows remained consistent throughout the week. January 20 saw $229.95 million in withdrawals, followed by $297.51 million on January 21.

The final two days posted $41.98 million and $41.74 million in outflows respectively.

Total net assets for Ethereum ETFs fell to $17.70 billion on January 23 from $20.42 billion on January 16.

Cumulative total net inflow dropped to $12.30 billion from $12.91 billion. Weekly trading volume reached $6.99 billion.

XRP ETFs recorded their first weekly outflow at $40.64 million after three consecutive weeks of inflows.