“B*tch better have my money..”; it’s a catchy tune most pop lovers might know by heart. Unfortunately, for Berachain, that’s exactly what they hear every time BERA crypto ticks lower.

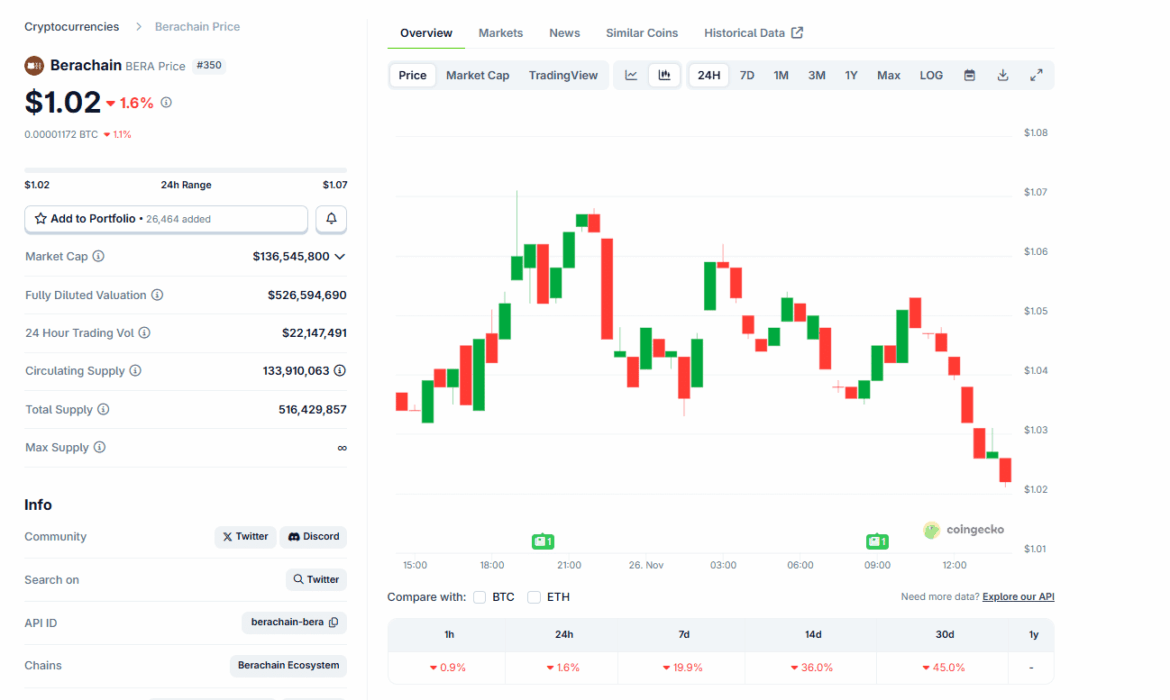

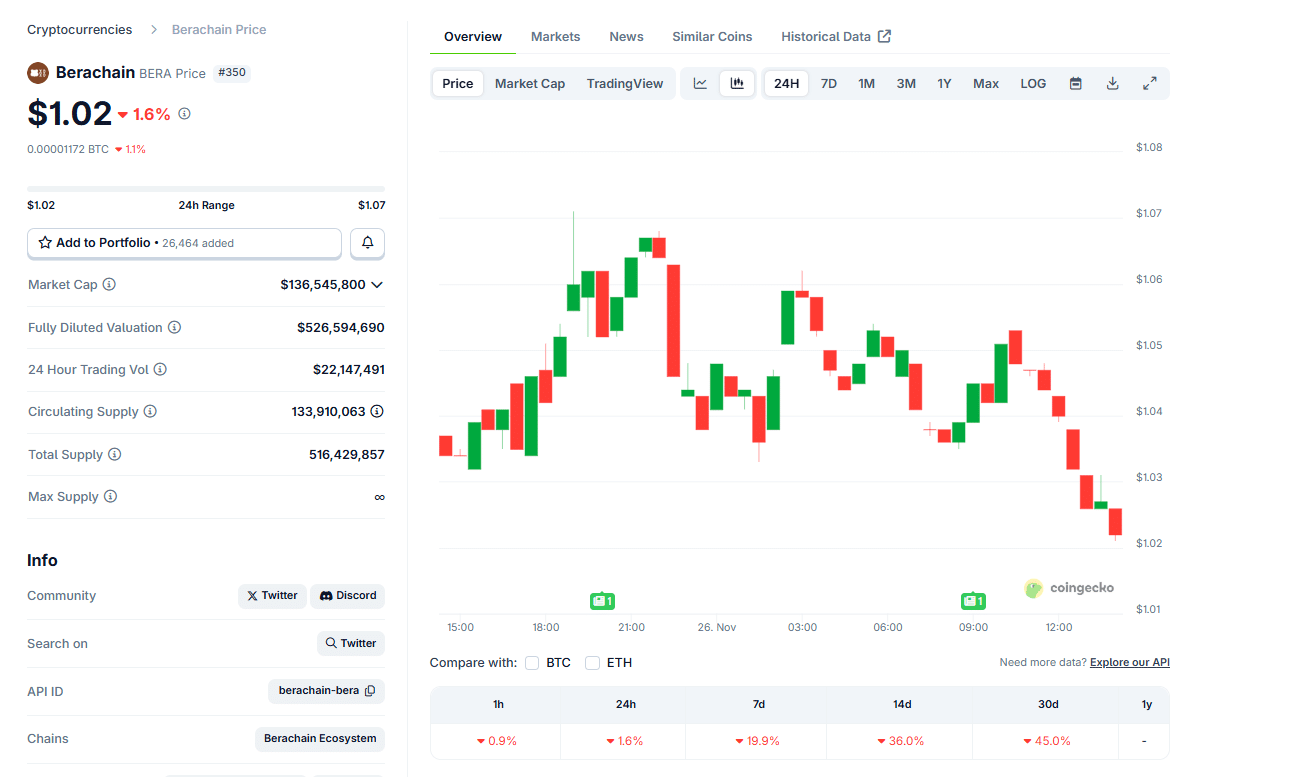

After flying to all-time highs in February 2025, BERA USDT has been dumping hard. To put it in numbers, BERA crypto is down -92% from all-time highs, and on November 22, it plunged to all-time lows.

In the past month of trading, BERA crypto has sunk -45%, losing nearly -20% in the last week of trading. The downtrend has been punishing HOLDers, but it could get worse if Brevan and Nova have their way.

(Source: Coingecko)

DISCOVER: Best New Cryptocurrencies to Invest in 2025

What is Berachain? What’s Special About This DeFi-Focused Project?

Berachain is a layer-1, similar to Solana, which hosts some of the top meme coins.

It is also Ethereum-compatible and scalable, aiming to address some of the key challenges DeFi protocols face when deploying on the first smart contract platforms: fragmented liquidity, high and unpredictable fees, and inefficient capital allocation.

Through this Proof-of-Liquidity, the platform replaced the proof-of-stake system by rewarding users whenever they supply liquidity to DeFi protocols, rather than staking, thereby locking away tokens.

BERA is used for paying gas fees and staking for PoL validators, but there are other tokens, including BGT, which is earned whenever you supply liquidity, and HONEY, the native stablecoin backed by other stablecoins like USDC and USDT.

Berachain launched in early February 2025, when the initial demand drove BERA to as high as $14 before selling off.

Along the way, there have been airdrops, including one in February, during which +15.8% of the BERA supply was distributed to testnet users and active community members.

They also rolled out PoL version 2, which enabled BEAR staking with rewards up to +300%.

On the 21st day, they said "Let there be PoL V2". And there was PoL V2. pic.twitter.com/zJIhsiC9NL

— Berachain Foundation

(@berachain) July 21, 2025

DISCOVER: 10+ Next Crypto to 100X In 2025

Why Is BERA Crypto Then Falling? Nova Has A Special Insurance Policy

First off, when Balancer was hacked in early November, DeFi protocols faced it rough, and though Berachain didn’t lose funds, like other DeFi tokens, BERA extended losses.

Affected stable pools on the BEX have been placed into emergency withdrawal mode, following best guidance from the Balancer team.

This allows existing LPs to safely withdraw their funds, though the pools are not active, and deposits are not enabled. Noting that the Balancer…

— Berachain Foundation

(@berachain) November 12, 2025

However, for neutral observers keen on how Berachain evolves, the controversy surrounding its investors could break BERA prices.

Yesterday, Unchained’s investigations revealed a side agreement between Berachain and Nova Digital Master Opportunities Fund Limited, a subsidiary of Brevan Howard Digital, a hedge fund. Brevan participated in Berachain’s Series B investment, offering $25M.

(Source: whosknave, X)

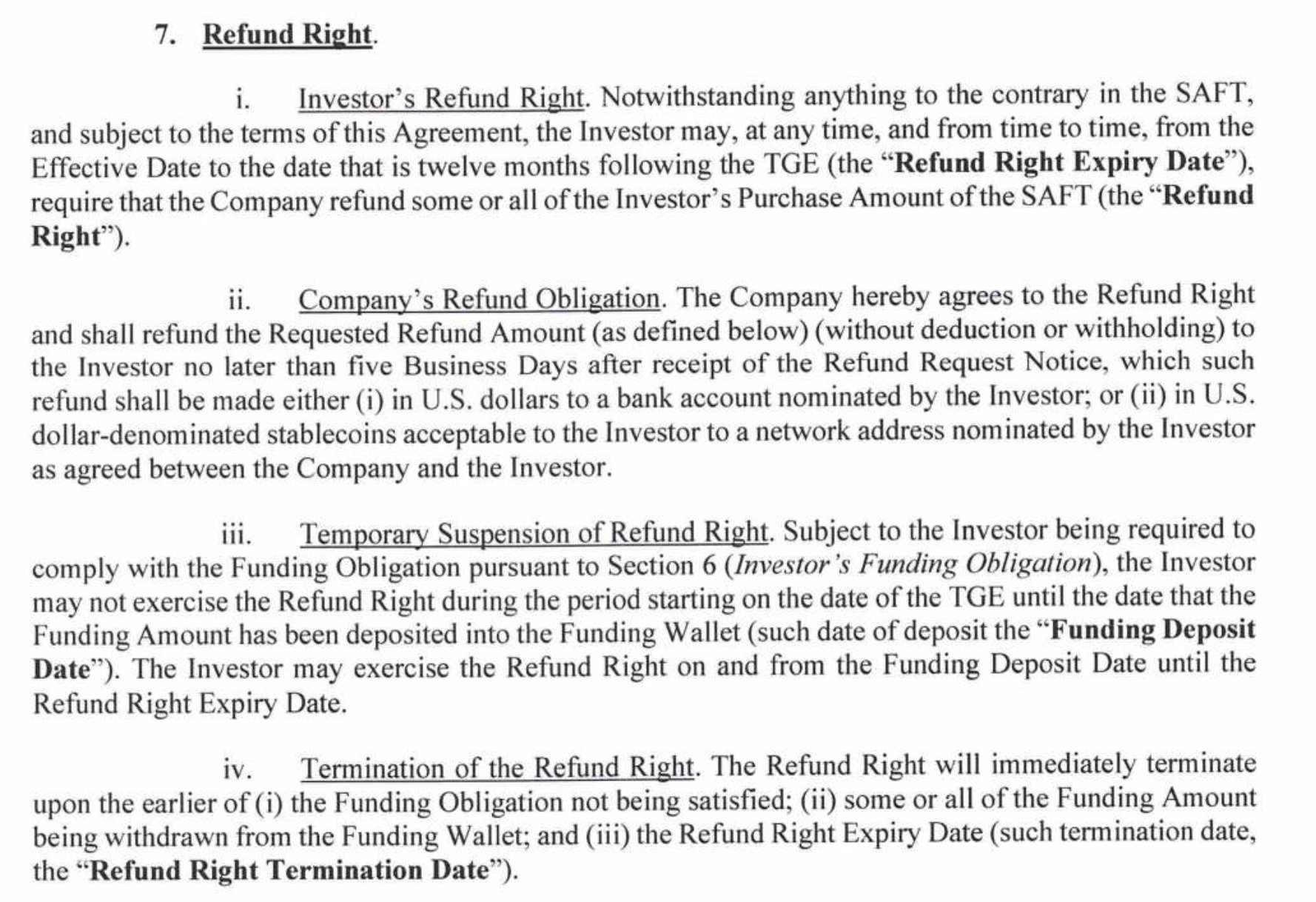

However, as part of the deal, there was a clause signed by Berachain’s lawyer, Jonathan LP, that exclusively gives Nova the right to demand repayments of some or all its principal in cash at any time up to one year after the BERA TGE event.

The TGE was on February 6, 2025, and until early February 2026, the hedge fund has the right to demand repayment from Berachain as insurance should BERA prices continue ticking lower. In essence, the clause was Brevan’s and Nova’s insurance against a price dump, and the only way they could recoup their funds was if BERA surged, printing higher highs only.

To trigger this refund, Nova had to deposit $5M into a designated Berachain wallet by March 8. This fund acted as collateral or a liquidity commitment.

For now, it remains to be seen whether the clause was exercised, and if Berachain had to repay Nova and Brevan in cash, it could explain why BERA USDT has been selling off steadily after peaking in February.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Berachain VC Troubles: Is This Why BERA Crypto is Down -92%?

- Berachain is DeFi-focused.

- BERA crypto down -92% from all-time highs.

- Nova has a right to demand a refund from Berachain

- Will BERA USDT continue falling?

The post Berachain VC Troubles: Is This Why BERA Crypto Is Down -92%? appeared first on 99Bitcoins.