Aave DAO approves Aavenomics and the purchase of $1M of AAVE every week from April 9. The funds will come from the protocol’s profits and aim to increase their ecosystem reserve. Will this DeFi giant extend the lead in DeFi days after announcing Lens Chain?

Aave, a DeFi giant and one of the largest protocols of its kind, running primarily on Ethereum, is entering a new phase following the official activation of Aavenomics.

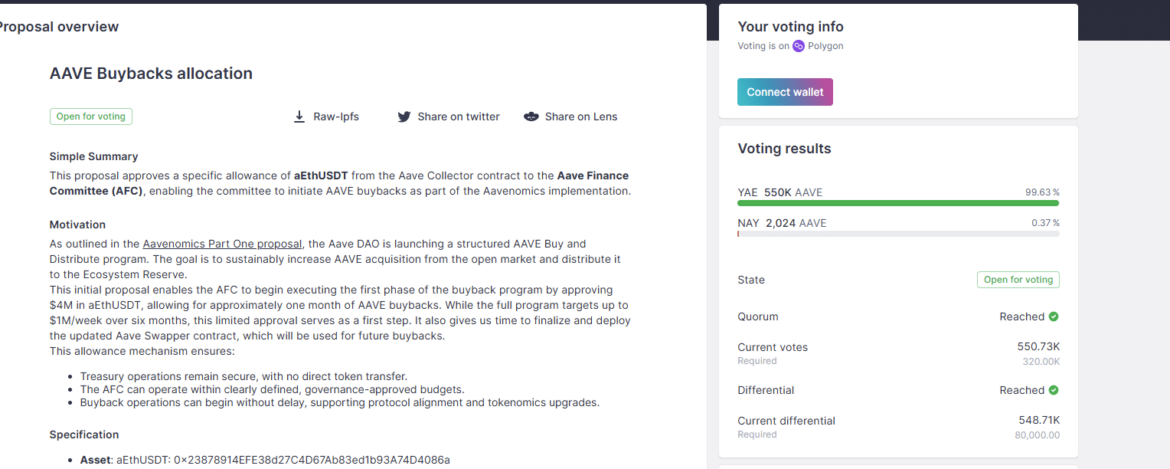

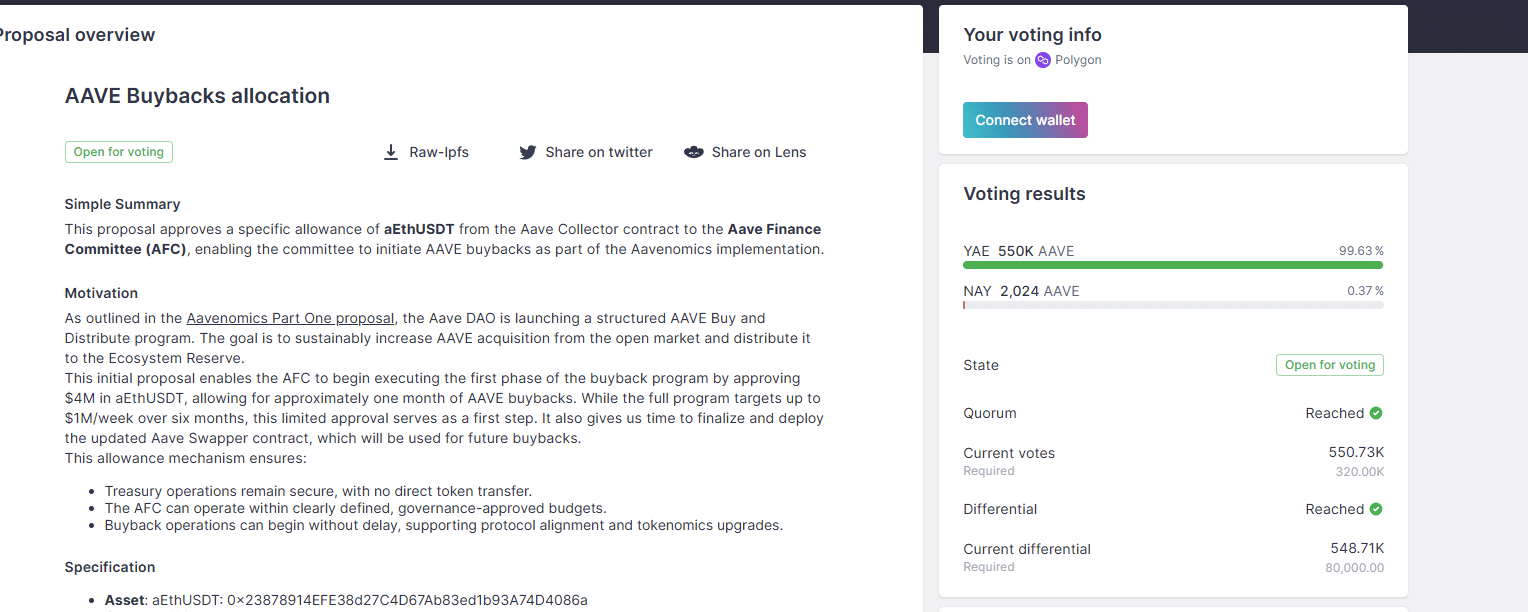

After a quorum was reached on April 7, Aave DAO holders approved Aavenomics, greenlighting the weekly purchase of $1 million worth of AAVE from secondary markets.

The proposal, approved by the Aave DAO with a majority vote, marks a bold experiment to align the protocol with its long-term incentives. It aims to make the broader Aave ecosystem sustainable and powered entirely by its profits. With this, the token could be one of the best cryptos to buy in 2025.

Explore: Best Meme Coin ICOs to Invest in April 2025

Aavenomics: What It Means for Aave

As expected, Aavenomics received overwhelming support from AAVE holders.

From the on-chain voting results, the proposal to scoop $1 million of AAVE from exchanges like Binance and Coinbase every week garnered 550,000 votes, well above the 320,000-vote threshold.

(Source)

Opposition, on the other hand, was negligible, with only 2,024 votes against the idea.

With the proposal approved, Aavenomics will begin on Wednesday, April 9—a move that Marc Zeller, the founder of the Aave Chain Initiative (ACI), said will be the start of a “new era” for the DeFi protocol.

The $AAVE aavenomics AIP now has Quorum.

Welcome to the new era for @aave.

1m$/week buybacks financed by protocol profits starting on Wednesday.

Just use Aave. pic.twitter.com/vRgwJbZIiX

— Marc “Billy” Zeller

(@lemiscate) April 6, 2025

The initiative will run for six months, during which the DAO will reevaluate and, if feasible, extend or expand the buyback program by increasing funds.

According to Zeller, AAVE buybacks are intended to be permanent. The decision to test this program first allows the team to assess its impact and, if necessary, make adjustments.

By the end of the six-month plan, roughly 2.5% of the total AAVE supply will have been removed from the circulating supply.

Today’s liquidations printed ~$0.5M in SVR profits, with no bad debt.

The Aave DAO still holds $100M in cash (70% stables).

At the current $AAVE price, DAO buybacks will own 2.5% of the supply by year’s end.

The Aave DAO is its own Saylor.

Just Use Aave. pic.twitter.com/84Gpj9zKVl

— Marc “Billy” Zeller

(@lemiscate) April 7, 2025

Overall, the team’s objective is to sustainably increase AAVE acquisition and distribute it to the protocol ecosystem reserve.

Will AAVE/USD Price Rally?

Whether AAVE prices will rise in response to this milestone remains to be seen. If prices tick higher, it could lift sentiment and trigger demand for other DeFi protocols, including some of the hottest presales to invest in 2025.

The timing is ideal for AAVE holders. After peaking in December, AAVE prices have tanked, shedding over 65%. Notably, sellers erased all gains posted in Q4 2024, with prices plunging below $130 on April 7.

(AAVEUSDT)

Currently, AAVE is back in the green, with bulls stepping in yesterday, pushing prices higher and countering the aggressive bears of April 6.

AAVE could trend higher if this momentum spills over to today. However, the real bull run will begin once the token closes above $160 and $200.

Explore: How to Buy USD Coin (USDC) – Beginner’s Guide

Eyes on Decentralized Social Media on the Lens Chain

The decision by the Aave DAO to reinvest some of the protocol’s profits into token buybacks follows yet another major milestone.

Last week, the team launched the Lens Chain mainnet, a platform built on Ethereum that specializes in developing rails for decentralized social media.

Lens is live on mainnet. SocialFi starts now. pic.twitter.com/nRNJ3E8NQ4

— Lens Chain (@LC) April 4, 2025

This Layer-2 platform, created by Avara—the parent company behind Aave—will offer composable and privacy-focused social media solutions.

To stay ahead of competitors, the Lens Chain will incorporate its decentralized data storage solution. Moreover, it will use GHO, the Aave algorithmic stablecoin, for paying gas fees.

DISCOVER: 16 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions & Analysis

Aave Buyback Program: Aavenomics To Buy $1M AAVE Weekly

- Aave token buyback 2025: Aave DAO greenlights $1M weekly AAVE purchases starting April 9

- Will Aavenomics boost AAVE demand?

- AAVEUSDT finds support after dropping 65% in three months

- Avara launches Lens Chain for SocialFi

The post Aave Ushers in Aavenomics, Agrees to Buy $1M of AAVE Tokens Every Week appeared first on 99Bitcoins.