Espresso (ESP) is designed to solve one of the biggest challenges in blockchain today: fragmented liquidity and isolated chains. The network provides shared sequencing, fast finality, and secure consensus through HotShot BFT, enabling rollups to interact seamlessly while maintaining decentralization.

This article breaks down how the network works, its native token and tokenomics, staking, and what makes ESP a unique player in the modular blockchain ecosystem.

What Is Espresso (ESP)?

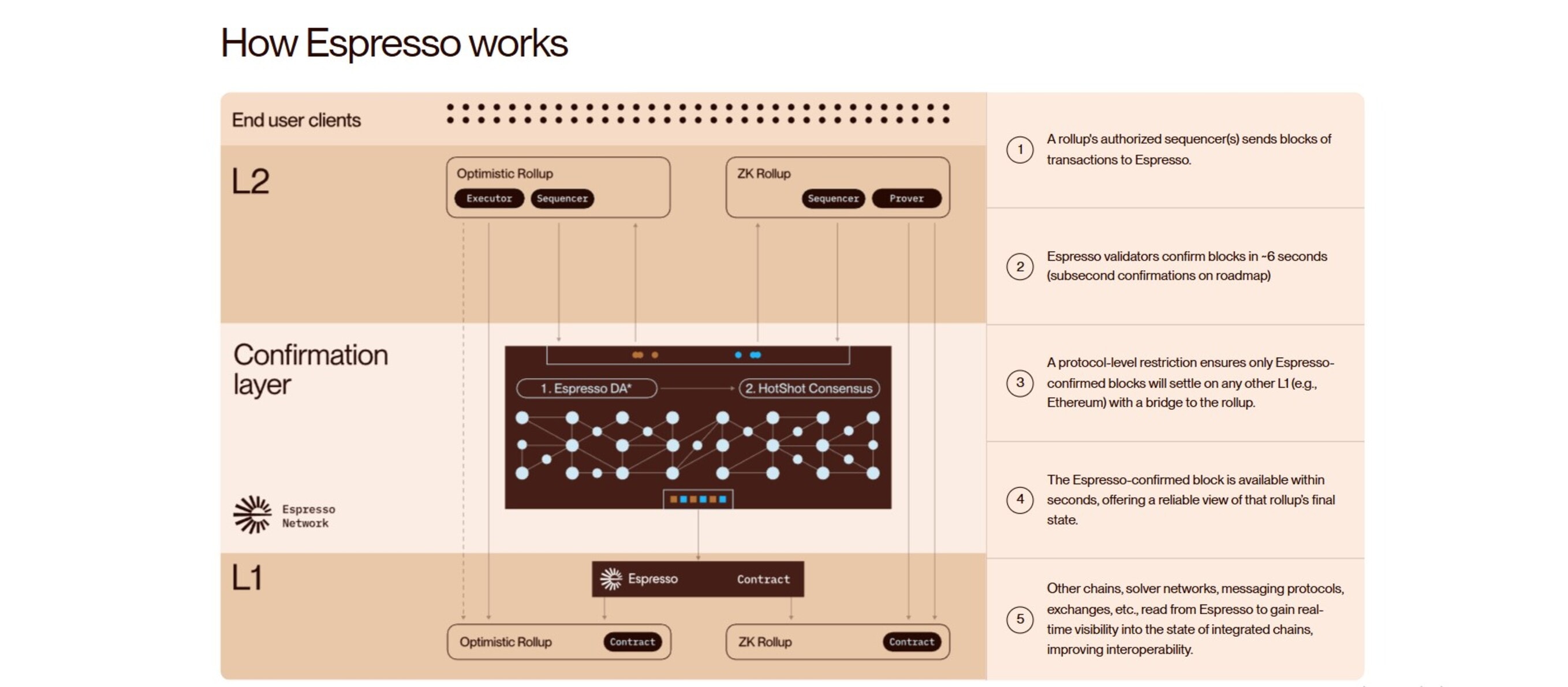

Espresso is a shared sequencing, coordination, and finality layer built for rollups. The Espresso Network acts as an infrastructure that sits alongside multiple chains, ordering transactions before they settle on their respective base layer. Instead of each rollup running its own centralized sequencer, Espresso provides a distributed network that coordinates activity across chains.

This design helps rollups achieve fast finality while improving interoperability within the broader ecosystem. By acting as a layer for rollups, Espresso reduces fragmented liquidity and makes it easier for users to move across chains without relying on a single chain for coordination.

The network is secured by its native token, ESP. Validators stake ESP to participate in BFT (Byzantine Fault-Tolerant) consensus, confirm blocks, and protect the protocol from compromise or error. In return, token holders can earn staking rewards, aligning incentives across early ecosystem participants, contributors, and the broader market.

What Problem Does Espresso Solve?

As more rollups launch, liquidity and users are becoming fragmented across chains. Each layer-2 network (L2) operates in isolation, resulting in high latency for cross-chain interactions that require Ethereum settlement.

Espresso Network solves the fragmentation problem by providing a shared sequencing marketplace where rollups outsource ordering to decentralized nodes, using auctions for rights and HotShot consensus for sub-4-second finality.

Rollups retain sovereignty through floor prices and revenue sharing, with EigenLayer restaking for security. This enables fast, coordinated transactions across chains without bridges and without compromising security or decentralization.

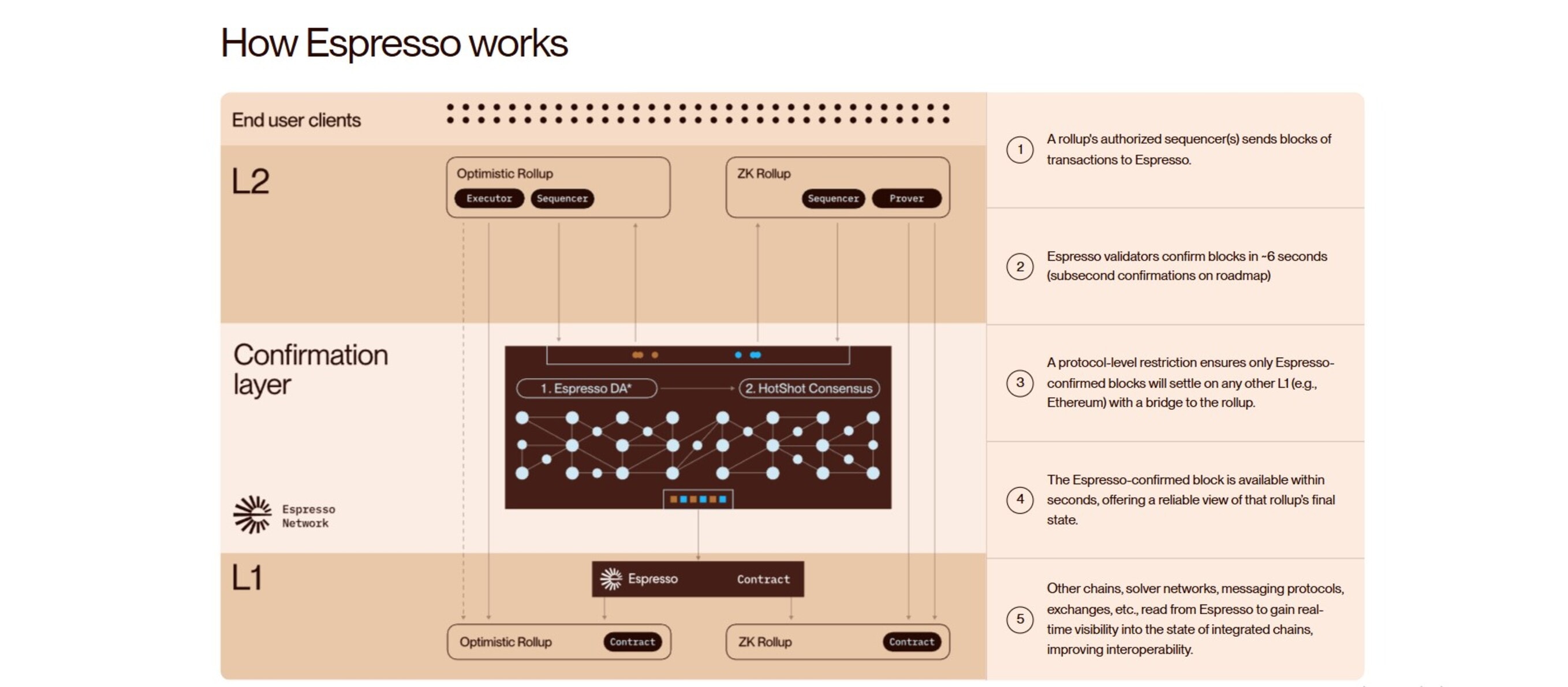

How Does Espresso Work?

Espresso uses a distributed sequencing protocol powered by BFT (Byzantine Fault Tolerance). Validators stake ESP tokens to participate in ordering transactions and confirming blocks across multiple rollups.

Instead of each rollup managing its own centralized sequencer, Espresso acts as a shared coordination layer. Transactions are ordered by the network and then settled on their respective base-layer chains.

This design improves security and enables fast finality across Espresso-integrated rollups. It also provides cryptographic proof that transactions were properly sequenced, increasing confidence among users and investors.

Espresso (ESP) Use Cases

- Network Staking and Security: Users stake ESP tokens as validators or delegates to secure the HotShot BFT consensus, earning staking rewards while risking slashing for downtime, errors, or malicious behavior.

- Shared Sequencing Participation: Validators stake ESP to participate in ordering transactions across Espresso-integrated rollups. The network acts as a coordination and finality layer, ensuring that transactions are sequenced correctly before they settle on their respective base-layer chains.

- Protocol Fees: ESP pays for transaction ordering, data availability via the Tiramisu layer, and cross-chain services, with fees supporting network incentives.

- Cross-Rollup Interoperability: Enables atomic transactions and fast finality (sub-6 seconds) across chains like ApeChain, RARI Chain, Celo, and Katana, for seamless NFT minting or DeFi actions without bridges.

- Protocol Execution and Operations: ESP powers network operations and rollup interactions through smart contract infrastructure, ensuring secure and verifiable execution of transactions across chains.

How Many ESP Tokens Are There?

Espresso (ESP) has a total supply of 3.59 billion tokens. The circulating supply is around 520.55 million ESP, with a fully diluted valuation (FDV) of about $207 million, based on recent market data. About 2.49% went to public sale, while the rest was allocated to staking incentives, ecosystem growth, team vesting, and operations. This structure prioritizes long-term network security via Proof-of-Stake participation.

Espresso (ESP) Tokenomics

Unlike some crypto projects, there’s no fixed maximum supply because staking rewards can introduce new tokens over time to support validator participation and network security.

Here’s how the initial supply was distributed:

- 27.36% to contributors with multi-year vesting

- 14.32% to investors under vesting schedules

- 10% allocated for a community airdrop, fully unlocked at launch

- 24.81% reserved for future grants, incentives, and ecosystem growth

- 15% for foundation operations to support infrastructure development

- 4.5% for liquidity support and market activity

- 3.01% for staking bonuses and decentralization incentives.

For a deeper dive into allocation strategies and economic design, see ESP tokenomics structure.

Team & Project Background

Espresso Systems was founded in 2020 by Stanford cryptography researchers Ben Fisch (CEO), Benedikt Bünz (Chief Scientist), Jill Gunter (Chief Strategy Officer), and Charles Lu (COO). The team specializes in zero-knowledge proofs and sequencing technology, with prior experience contributing to Monero, Ethereum Foundation projects, and Libra.

While the team began working in 2020, Espresso emerged from stealth in 2022 with $33 million in seed funding from Greylock, Polychain, and Coinbase Ventures, followed by $32 million in Series B funding from a16z and Sequoia, for a total of $ 64 million raised.

Although Espresso has launched its first mainnet, many of its key features are still being rolled out. Regardless, the team’s expertise in distributed systems and focus on coordination infrastructure continue to position Espresso as a high-performance base layer for rollups.

For a deeper dive into how settlement and sequencing work at the protocol level, check out blockchain finality and settlement explained.

Is Espresso (ESP) a Good Investment?

Whether ESP is a good investment depends on your risk tolerance and outlook on rollup infrastructure. The project targets a core crypto problem of sequencing and finality for rollups which could drive demand if adoption grows.

However, blockchain markets are volatile, and ESP’s value hinges on network usage, staking rewards, and wider ecosystem traction. Always do your own research and never invest more than you can afford to lose.

For more guidance on investing in promising projects, check out best cryptocurrency to buy.

How to Buy Espresso (ESP)

Step 1: Create and Verify an Exchange Account

To start, choose a reputable crypto exchange that lists ESP, such as KuCoin or Binance. You need to provide an email or phone number and create a strong password. Most exchanges also require identity verification (KYC), which means submitting a government-issued ID and sometimes a selfie for proof of identity.

Step 2: Deposit Funds

Once your account is verified, you need funds to buy ESP. You can deposit fiat currencies like USD or EUR directly or transfer other cryptocurrencies such as USDT, ETH, or BTC.

Step 3: Buy ESP

After funding your account, go to the exchange’s spot market and search for ESP or buy directly if the platform has a “Quick Buy” option. You can place a market order, which buys instantly at the current price, or a limit order, which executes when ESP reaches a price you set.

Step 4: Secure Your Tokens

While exchanges provide convenient storage, it’s best to store ESP safely in a crypto wallet. Hardware wallets, mobile wallets, or browser wallets compatible with ERC‑20 tokens give you control of your private keys. Secure wallets reduce the risk of hacks or exchange failures and let you participate in staking or governance without leaving tokens on the exchange.

ESP Vs Bitcoin

| Feature | Espresso (ESP) | Bitcoin (BTC) |

| Primary Role | Shared sequencer for Ethereum L2 rollups phemex+1 | Digital gold, Layer 1 store of value |

| Consensus | HotShot (BFT, Proof-of-Stake) | Proof-of-Work (mining) |

| Transaction Speed | Sub-second pre-confirmations | 10-60 minutes |

| Focus | Cross-chain composability and scaling | Security & decentralization |

| Total Supply | 3.59B | 21M |

| Launch Year | Mainnet 2024 | 2009 |

| Market Cap (Feb 2026) | $32M | Trillions |

Risks and Considerations

Investing in ESP comes with several risks that traders and token holders should understand. Market volatility is a major factor, as ESP’s price can swing sharply due to crypto cycles, network adoption, and speculative trading.

While Espresso is designed to reduce liquidity fragmentation and improve interoperability, liquidity fragmentation remains a concern, as low liquidity on certain rollups could affect trading efficiency.

Finally, the network is still evolving, with key features such as permissionless staking, full validator decentralization, and integrated rollups being rolled out, which could affect the network’s stability and token demand as upgrades progress.

Conclusion

Espresso (ESP) offers a unique solution for rollup coordination, combining fast finality, staking incentives, and interoperability. While the network shows strong potential, consider market volatility, protocol risks, and evolving features. ESP’s role in securing the network and supporting the ecosystem makes it an important token to watch.

FAQs

Espresso stands out as a shared sequencing and finality layer for rollups, rather than a traditional base layer. It uses HotShot BFT consensus to provide fast finality, reduce fragmented liquidity, and enable seamless interoperability across multiple chains.

ESP is the native token of the network, used for staking, securing the protocol, earning rewards, and participating in network incentives. It aligns the interests of validators, early ecosystem participants, and other users.

You can buy ESP on major crypto exchanges that list the token, using fiat or other cryptocurrencies. After buying, we recommend storing ESP safely in a crypto wallet.

Espresso operates as a layer for rollups rather than a single chain. It integrates with multiple chains and rollups, providing coordination and finality while supporting cross-chain interoperability.

Yes. Users can stake ESP to participate in network consensus and earn rewards. Token holders also influence governance decisions, including protocol upgrades and foundation operations.