BlockDAG (BDAG) raised over $452 million in its recently concluded presale and is scheduled for exchange listing on February 16, 2026. The presale raise is more than any token has done in a single presale, and for this reason, BDAG is generating significant interest among traders and early-stage investors.

With more attention on BDAG, it can be easy to get lost in the hype and invest blindly. Therefore, in this article, we explore key factors influencing Blockdag’s price, provide technical and fundamental analyses, and forecast its price trajectory from 2026 to 2030 to help you make informed decisions.

BlockDAG (BDAG) Overview

BlockDAG is a Layer-1 blockchain built on a Directed Acyclic Graph (DAG) architecture rather than a traditional linear chain. Instead of producing blocks one after another, the network processes multiple blocks in parallel, eliminating orphan blocks and improving overall efficiency.

This design allows BlockDAG to scale throughput significantly, with the protocol targeting over 100 blocks per second under optimal conditions. A key technical feature of BlockDAG is its hybrid model. The network supports UTXO-based transactions for fast, lightweight payments and offers EVM-compatible smart contracts for decentralized applications.

BDAG is the native utility token of the network. It is intended to be used for transaction fees, mining rewards, and participation across the BlockDAG ecosystem as it evolves. Like most early-stage Layer-1 tokens, BDAG’s future value will depend on real adoption (mainnet stability, developer traction, and sustained on-chain activity).

For investors, BlockDAG is in the high-risk, high-upside category. Its architecture is promising on paper, but price performance over the next few years will ultimately hinge on whether the project can move beyond early hype and deliver a functional, competitive blockchain, especially with tons of Layer-1 chains vying for the top spot.

BlockDAG Price History and Performance

BlockDAG (BDAG)’s presale recently ended after raising over $450M. Since the token is targeting a February launch on exchanges, there is limited public liquidity and inconsistent price reporting across crypto portfolio trackers.

- Pre-Mainnet Trading Activity: During its early trading phase, Blockdag’s price action reflected typical low-liquidity conditions, including sharp short-term moves, a thin order book, and volatility driven more by market sentiment than by fundamentals.

- Key Inflection Points Ahead: Meaningful price discovery for BDAG is expected to occur after the mainnet launch, major exchange listings, and sustained network usage, events that will likely shape its long-term price trajectory through 2026 and in the upcoming years.

- Historical Limitations: BlockDAG has not yet completed a full market cycle, meaning historical price data is shallow. Most valuation to date has been forward-looking, pricing in expectations around mainnet execution, throughput performance, and future ecosystem growth rather than proven demand.

Early-stage tokens often experience significant volatility before settling into structural ranges. Compare Blockdag with how low-liquidity tokens can behave over market cycles, using this bonk price prediction, which examines price swings in one of Solana’s active meme ecosystems.

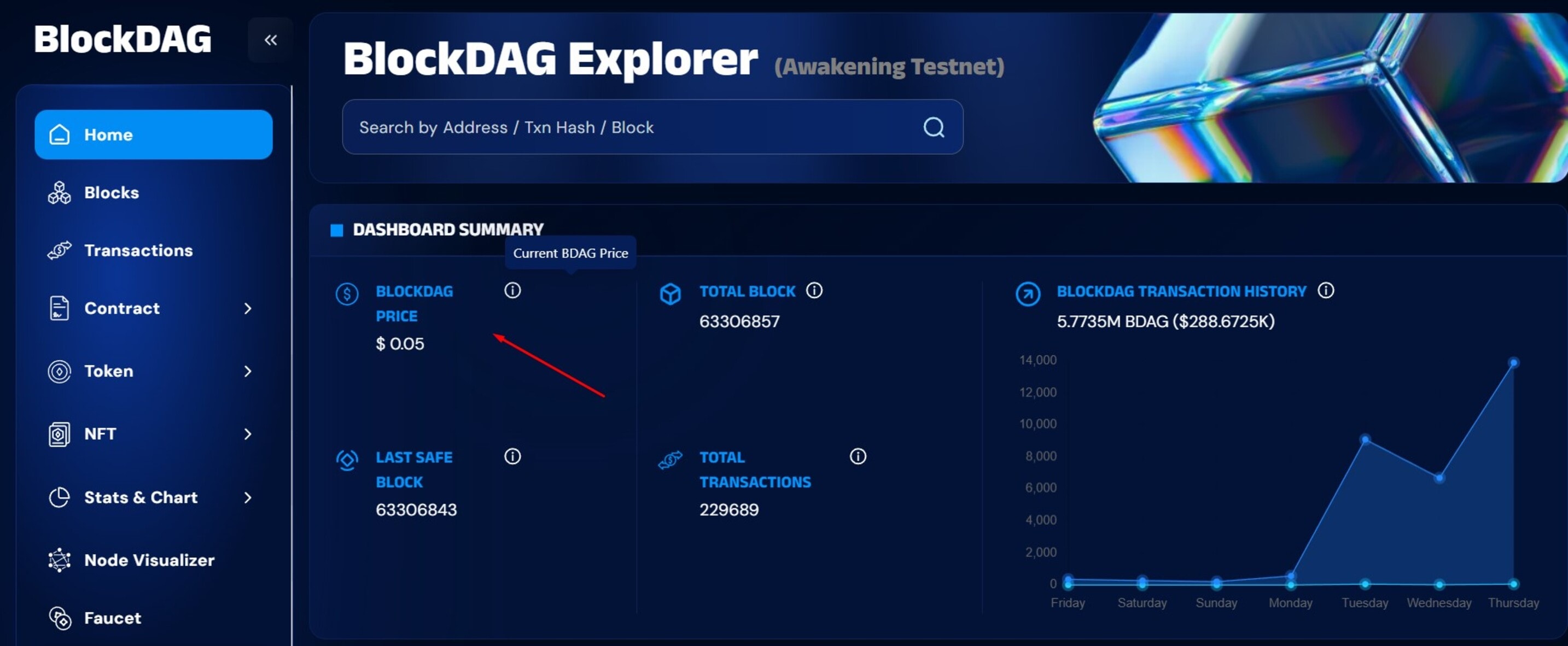

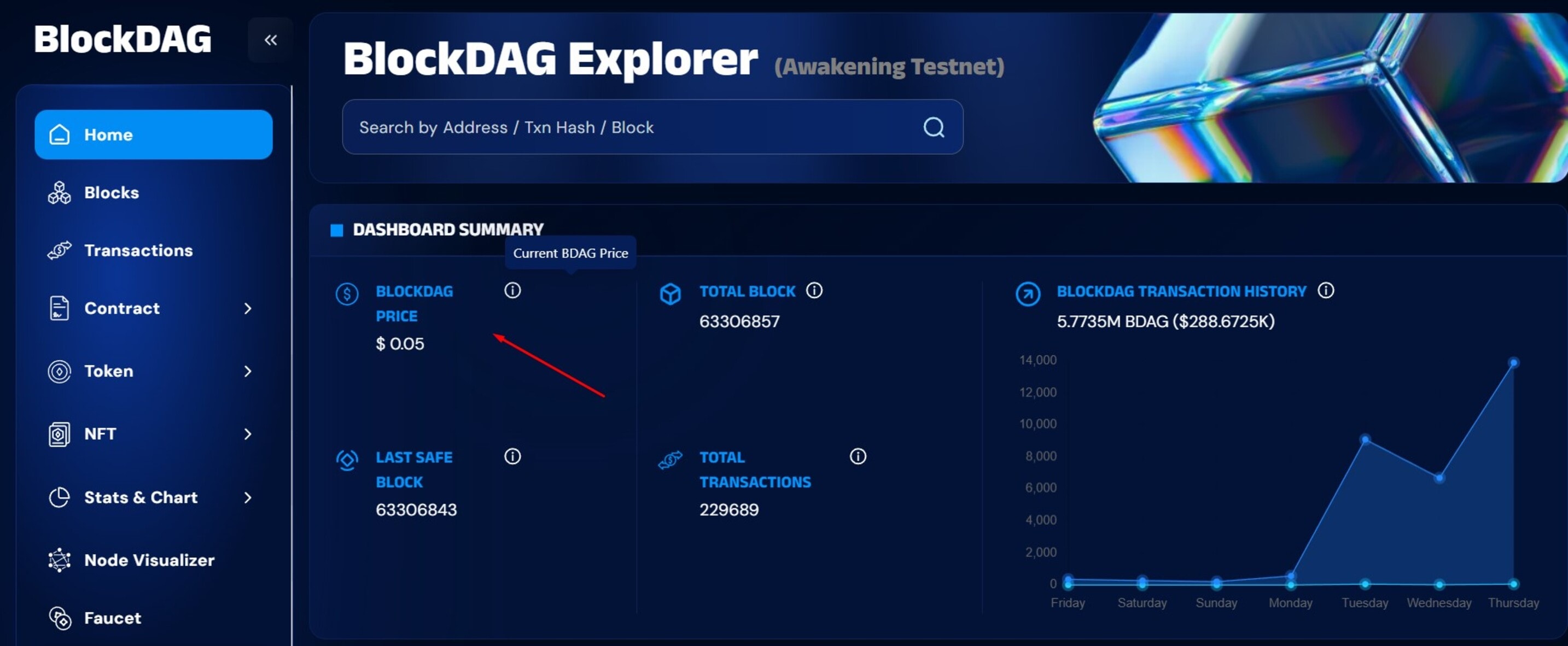

BDAG Current Market

BlockDAG (BDAG) is currently trading at $0.05, reflecting its status as an early-stage Layer-1 project still in the pre-adoption phase. Price action remains largely sentiment-driven, moving in line with broader altcoin weakness in early 2026 rather than showing independent momentum.

While the token did exceedingly well, becoming the largest single presale in the cryptocurrency space, liquidity remains low but is improving gradually. BDAG has yet to experience the kind of sustained volume that accompanies full price discovery.

- Current price: $0.05-$0.06 USD

- Estimated market cap: $120-$180 million (based on current circulating supply estimates)

- Circulating supply: 50 billion BDAG

- Max supply: 150 billion BDAG

- Market structure: Low-to-moderate liquidity, high volatility typical of early-stage Layer-1 tokens

Until broader exchange listings, mainnet performance data, and consistent on-chain usage emerge, the token’s price is likely to remain range-bound and highly sensitive to overall crypto market conditions.

How Do NFTPlazas Experts Predict BlockDAG’s Price?

For a project at BDAG’s stage, our price projections are less about chart history and more about how the market is likely to react as the asset moves from presale to open trading.

So for BDAG, our first outlook is on post-listing dynamics. This includes official listing price, expected volatility after exchange listings, early liquidity depth, sell pressure from presale participants, and how quickly the market establishes reliable price levels.

We also watch execution and adoption signals, including network performance, developer activity, and real transaction usage, which determine whether BDAG demand is sustainable or purely speculative.

Rather than long-term technical indicators, our analysis emphasizes market trends and structure: volume trends, support/resistance zones, volatility swings, and how BDAG moves relative to Bitcoin and high-beta altcoins.

In addition, supply dynamics are a major price driver for early-stage assets like BDAG. So understanding tokenomics, including circulating supply, unlock schedules, and emission rates, is essential for forecasting long-term value. Learn more about how token distribution affects valuation in our “What is tokenomics?” guide.

Having said that, please note that all forecasts are educational and purely estimates, not guarantees. They are intended to help you frame risks and opportunities rather than to provide investment advice.

BDAG Technical Analysis

BDAG is entering exchange trading on February 16, 2026, and the early technical structure will be largely driven by post-listing liquidity and market sentiment. Initial trading is expected to be volatile, with sharp moves around key price levels.

Key Price Levels

- Trading Range (Speculative Post-Listing): $0.05 – $0.08

- Critical Inflection Point: $0.055. Holding above supports short-term stability; a break below could trigger deeper downside.

- Immediate Resistance: $0.07 – $0.08. Reclaiming this level with volume is necessary to shift momentum toward buyers.

Support Levels

| Support Level | Price (USD) |

| S1 | $0.05 |

| S2 | $0.045 |

| S3 | $0.040 |

| S4 | $0.035 |

| S5 | $0.030 |

Resistance Levels

| Resistance Level | Price (USD) |

| R1 | $0.060 |

| R2 | $0.065 |

| R3 | $0.070 |

| R4 | $0.075 |

| R5 | $0.080 |

Note: These levels are speculative post-listing ranges, based on likely liquidity and market interest. Price action could move quickly as early buyers and presale holders adjust positions.

BDAG Price Prediction 2026

| Month | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| February | $0.05 | $0.06 | $0.07 |

| March | $0.055 | $0.065 | $0.075 |

| April | $0.058 | $0.07 | $0.08 |

| May | $0.06 | $0.072 | $0.082 |

| June | $0.0062 | $0.075 | $0.085 |

| July | $0.0065 | $0.078 | $0.09 |

| August | $0.0067 | $0.08 | $0.092 |

| September | $0.07 | $0.082 | $0.095 |

| October | $0.072 | $0.085 | $0.097 |

| November | $0.075 | $0.087 | $0.10 |

| December | $0.078 | $0.09 | $0.12 |

BDAG Price Prediction 2027

| Month | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| January | $0.085 | $0.095 | $0.105 |

| February | $0.088 | $0.098 | $0.11 |

| March | $0.09 | $0.10 | $0.112 |

| April | $0.092 | $0.103 | $0.115 |

| May | $0.095 | $0.105 | $0.117 |

| June | $0.097 | $0.108 | $0.12 |

| July | $0.10 | $0.11 | $0.123 |

| August | $0.102 | $0.112 | $0.125 |

| September | $0.105 | $0.115 | $0.128 |

| October | $0.107 | $0.118 | $0.13 |

| November | $0.11 | $0.12 | $0.133 |

| December | $0.112 | $0.122 | $0.135 |

BDAG Price Prediction 2028

| Month | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| January | $0.125 | $0.135 | $0.148 |

| February | $0.128 | $0.138 | $0.15 |

| March | $0.13 | $0.14 | $0.152 |

| April | $0.132 | $0.142 | $0.155 |

| May | $0.135 | $0.145 | $0.158 |

| June | $0.138 | $0.148 | $0.16 |

| July | $0.14 | $0.15 | $0.162 |

| August | $0.142 | $0.152 | $0.165 |

| September | $0.145 | $0.155 | $0.168 |

| October | $0.147 | $0.157 | $0.17 |

| November | $0.15 | $0.16 | $0.173 |

| December | $0.152 | $0.162 | $0.175 |

Long-term Forecast: BDAG Price Prediction for 2026, 2027, 2028, 2029, and 2030

| Year | Price Prediction (USD) |

| 2026 | $0.07 |

| 2027 | $0.12 |

| 2028 | $0.16 |

| 2029 | $0.22 |

| 2030 | $0.30 |

What Factors Influence BlockDAG’s Price?

1. Smart Contract and dApp Adoption

Unlike some DAG-based networks, BDAG supports EVM-compatible smart contracts, allowing developers to deploy DeFi projects, NFTs, and payment solutions. The more applications running on the network, the higher the demand for BDAG to power transactions. Early adoption by developers and popular blockchain-based decentralized applications can create a network effect, pushing the price upward as utility grows.

2. Successful Exchange Listings

BDAG’s first exchange listing on February 16, 2026, is a major price catalyst. How the token trades immediately post-listing, including liquidity levels, order book depth, and presale holder activity, will determine the initial market price discovery. A smooth listing with steady volume could set the stage for sustained growth, similar to what you might see in the market performance of some top-performing cryptocurrencies in the market.

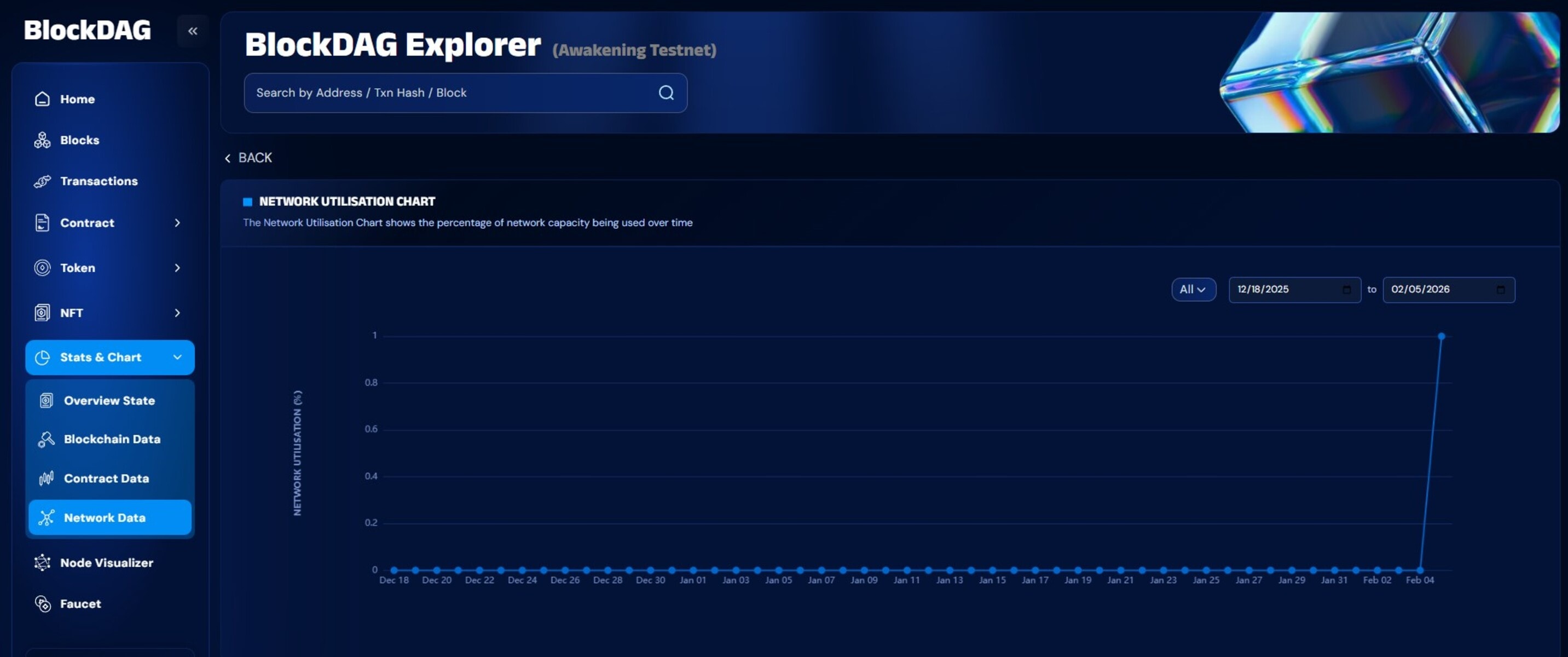

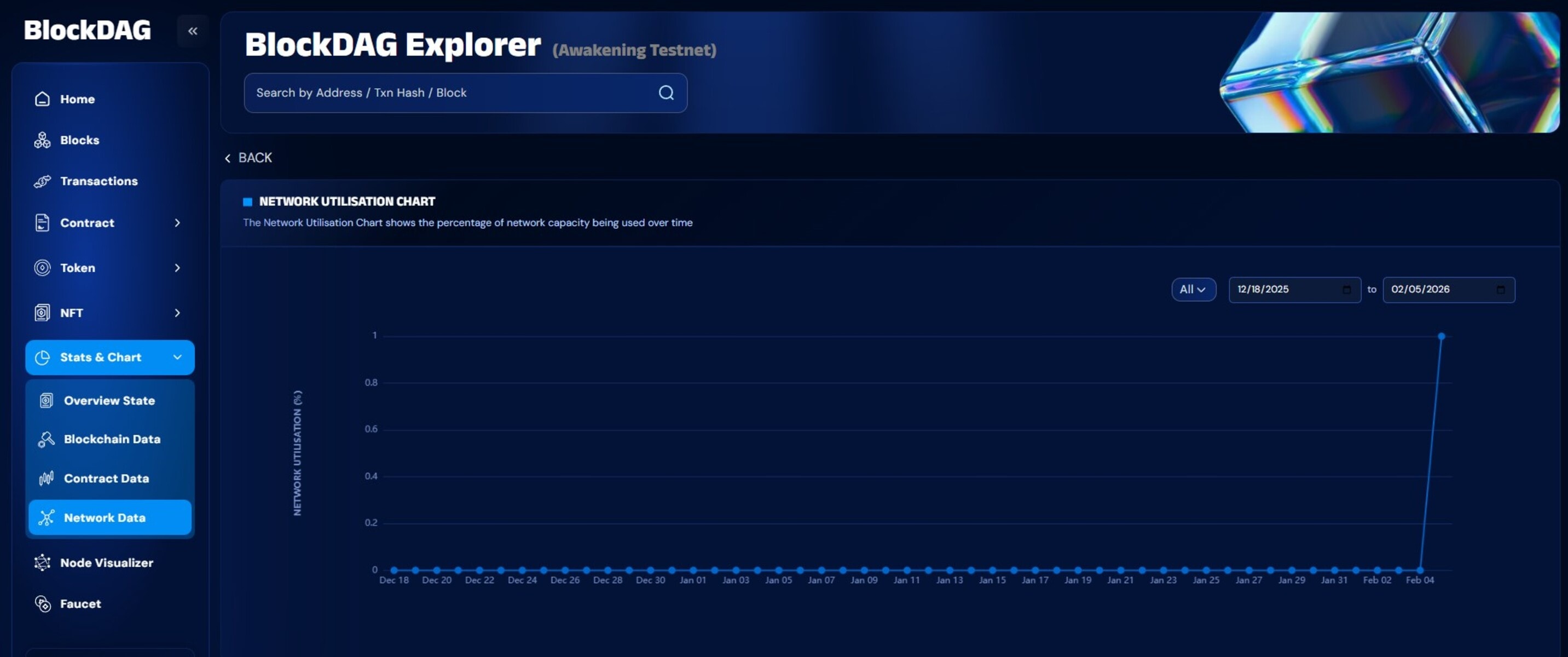

3. Real-World Adoption Metrics

BlockDAG’s price will respond to tangible real-world usage. Metrics such as daily active addresses, transaction counts, and the volume of value transferred on-chain provide traders with insight into the network’s health. Sustained growth in these metrics signals strong adoption, which often precedes meaningful price appreciation.

4. Presale and Token Distribution Effects

BDAG Coin raised over $452 million in its presale, making token distribution a crucial factor in early price movements. How these tokens are unlocked, sold, or held by early adopters will impact short-term resistance and support levels. For example, if investors sell a large portion of their holdings immediately, it could temporarily push the price down and likely cause the crypto asset to fail in the long run, even if the network fundamentals are strong.

Final Thoughts

BlockDAG (BDAG) is entering a critical phase with its exchange listing in February 2026, and early trading will likely be volatile. Its long-term value depends on actual network adoption, smart contract usage, and the stability of its parallel-block architecture, rather than short-term hype or social media sentiment.

The presale success, raising over $452 million, shows strong investor confidence, but token unlocks and post-listing liquidity could create temporary price swings. For traders, the key is watching network performance, developer activity, and real transaction growth over the coming months.

FAQs

BDAG has potential as a long-term play if the network delivers on its technical promises, sees real adoption, and builds an active ecosystem. Its hybrid UTXO–EVM structure and high throughput are compelling, but long-term success hinges on usage, developer activity, and ecosystem growth, not just speculation. Like all early-stage Layer‑1 tokens, it’s higher risk and better suited for traders who can tolerate volatility.

Reaching $5 would imply a massive valuation, far beyond current capitalization and adoption levels. For BDAG Coin to get anywhere close, it would need huge transaction volume, broad dApp usage, significant real-world adoption, and a market cycle that rotates deeply into infrastructure tokens. In most realistic scenarios, $5 is extremely optimistic by 2030, especially given BDAG’s large max supply and early-stage status.

Price forecasts are inherently uncertain, especially with early-stage networks. Based on adoption assumptions, exchange liquidity growth, and network usage expansion, a 2030 range of $0.20–$0.30 is likely in a neutral-to-bullish environment. Bearish conditions could keep the price below that, while a highly bullish scenario with strong ecosystem growth could push it modestly higher.

Price predictions are educated estimates based on fundamentals, adoption trends, supply dynamics, and market fluctuations. Use them as one of many tools for planning and risk management, and always paired with your own research before making investment decisions.