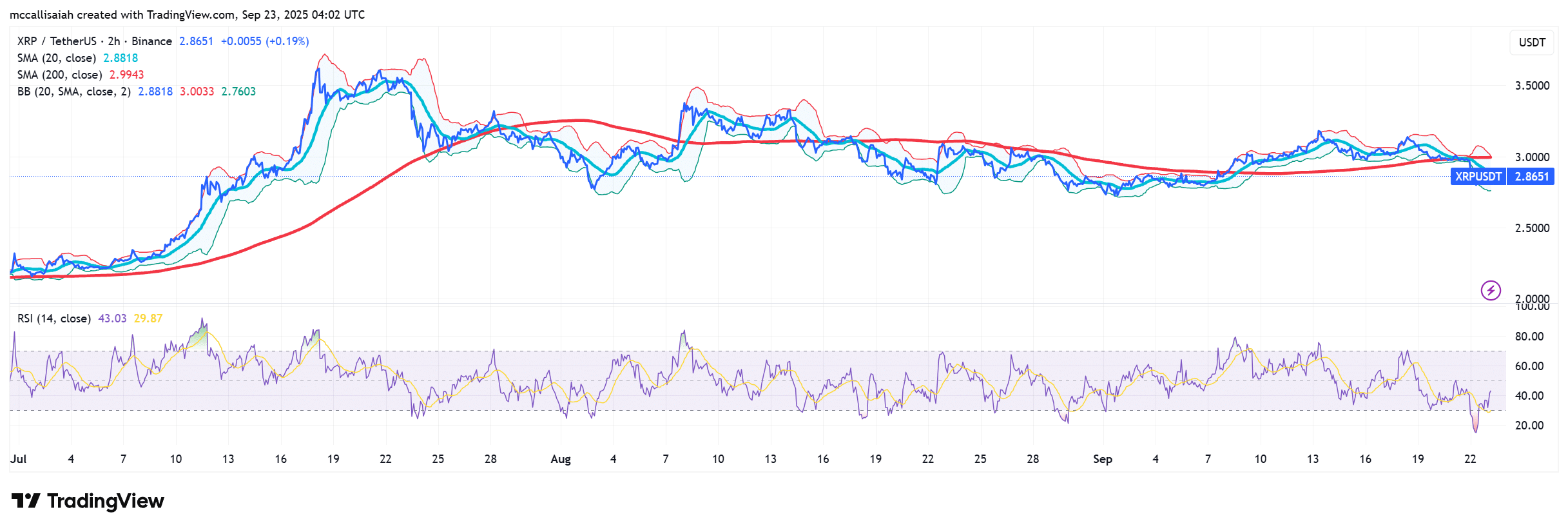

Institutional crypto companies are all in on the XRP price. Dare we say based? XRP’s run topped out at $3.50 earlier this month before sliding to $2.6935 on September 22, its lowest since July. The drop marks five straight days of losses, even with rate cuts and ETF speculation in the backdrop.

Meanwhile, technical indicators are tilting bearish for XRP. The 200-day SMA hangs above $2.99, RSI sits in the 40s, and a head-and-shoulders pattern forms with a neckline at $2.85. A clean break could drag prices toward $2.70.

“Key level being retested… hold the higher low here, and $BTC likely pushes for $120,000 next,” trader Jelle noted, pointing to Bitcoin’s role in steering sentiment across majors.

Could October ETFs Rewrite the Bullish XRP Price Narrative?

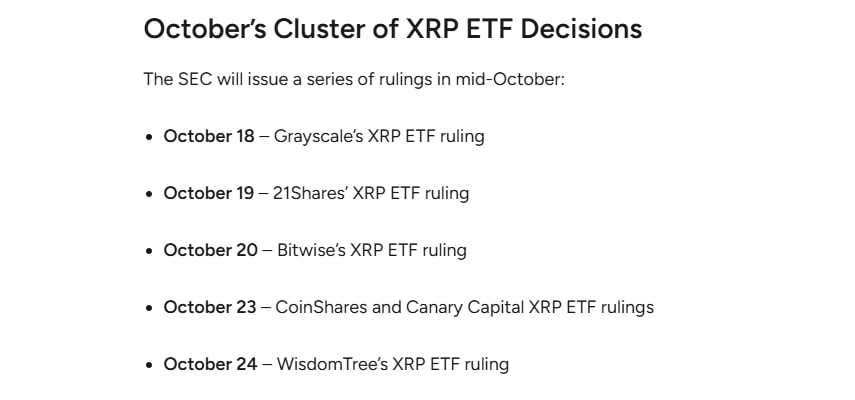

The next big catalyst for XRP arrives in October, when the SEC must decide on seven XRP-spot ETF applications from issuers including 21Shares, Bitwise, and Grayscale.

Final deadlines for the ETF approvals are between October 18 and October 25, with 99Bitcoins analysts speculating that the agency may approve all at once to avoid giving any issuer a first-mover advantage.

If ETFs launch, they could unlock historic demand. Republican lawmakers are already pushing to include crypto in 401(k) retirement plans, citing a potential market of 90m Americans.

JUST IN:

US lawmakers ask SEC to implement President Trump's executive order opening the $12.5 trillion 401k retirement market to crypto. pic.twitter.com/aADcrfAjm2

— Watcher.Guru (@WatcherGuru) September 22, 2025

“We encourage the SEC to provide swift assistance… and review bipartisan legislation concerning accredited investors,” wrote nine House Republicans in a September 22 letter.

DISCOVER: 20+ Next Crypto to Explode in 2025

What Do the Numbers Say About XRP’s Market Position?

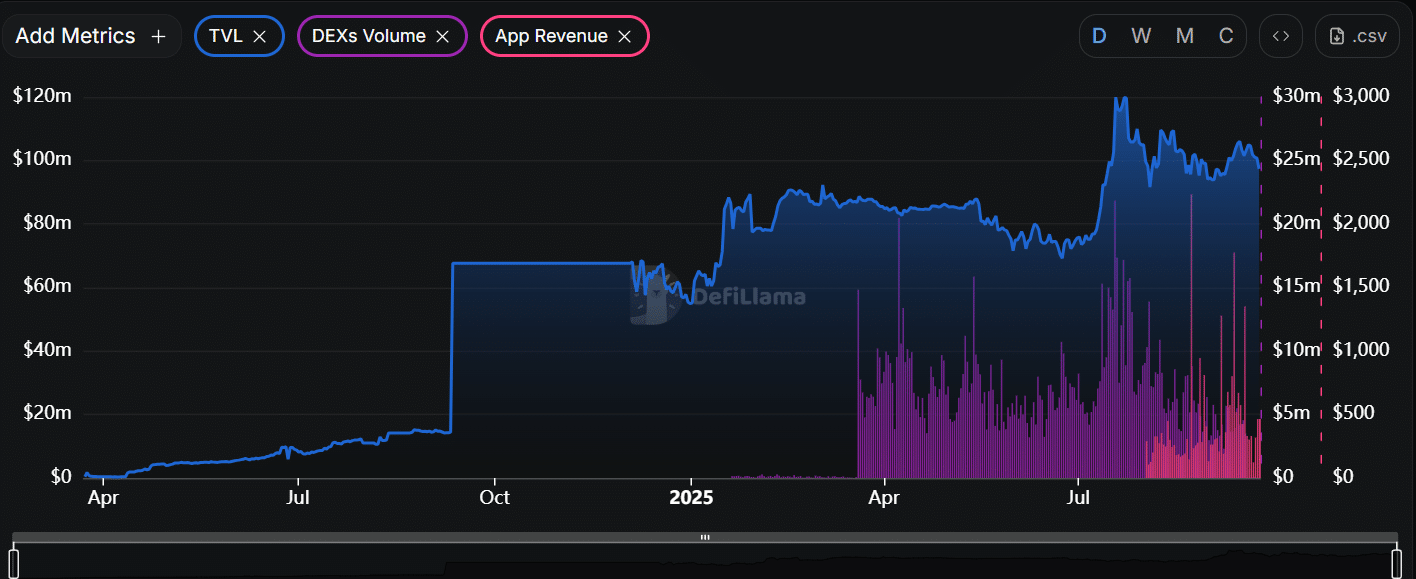

Despite a 2.7% gain in September, XRP remains shaky after August’s 8.1% slide. According to DeFi Llama, liquidity is thinning.

Rising Treasury yields and a stronger dollar pressure the crypto markets. The DXY has climbed back to 97.33, drawing money toward dollar-backed assets at the expense of speculative coins.

For bulls, the rebound hinges on a further Fed pivot and Wall Street continuing to rally support for ETFs.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

Will Grayscale and Capitol Hill Trigger an XRP Rebound?

The bullish setup for XRP hinges on three catalysts: 1) ETF approvals, 2) 401(k) integration, and 3) Ripple winning a US banking license.

“If rates continue to decline, does that money look to find a home elsewhere? If so, where does it go?” asked Nate Geraci, NovaDius Wealth Management.

We could see XRP break above $3 and retest $3.20. However, bearish momentum may drag it toward $2.50 support without confirming each catalyst.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Key Takeaways

- Institutional crypto companies are all in on the XRP price. Dare we say based? XRP’s run topped out at $3.50 earlier this month.

- For bulls, the rebound hinges on a further Fed pivot and Wall Street continuing to rally support for ETFs.

The post XRP Price Drops Below $2.85 as ETF Hopes and 401(k) Access Loom appeared first on 99Bitcoins.