On September 3, Ondo Finance announced the launch of Ondo Global Markets. Could Ondo’s tokenized Wall Street model reshape global equity markets, and what does it mean for the future of stocks? Let’s dive in.

The platform is designed to let non-U.S. investors access tokenized versions of over 100 U.S. stocks and ETFs anytime.

The company also plans to expand this list to more than 1,000 by the end of the year.

Marketed as the start of “Wall Street 2.0,” Ondo presents the rollout as a step forward in global finance, much like how stablecoins made money markets more accessible.

With this system, users can buy, sell, transfer, mint, and redeem tokenized securities around the clock. Minting and redemptions, however, still need to align with market hours, and all activities remain bound by jurisdictional and legal rules.

To protect investors, Ondo has established strong safeguards, including daily third-party checks of reserves, a bankruptcy-remote framework, and a security agent that holds first-priority security rights over the assets.

A key part of the model is liquidity. Tokenized stocks from Ondo reflect the liquidity of the securities they represent, which means trades can happen with low slippage, without the need to build fresh market depth on-chain.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

ONDO Price Analysis: Can the Token Hold Bullish Momentum After Wall Street 2.0?

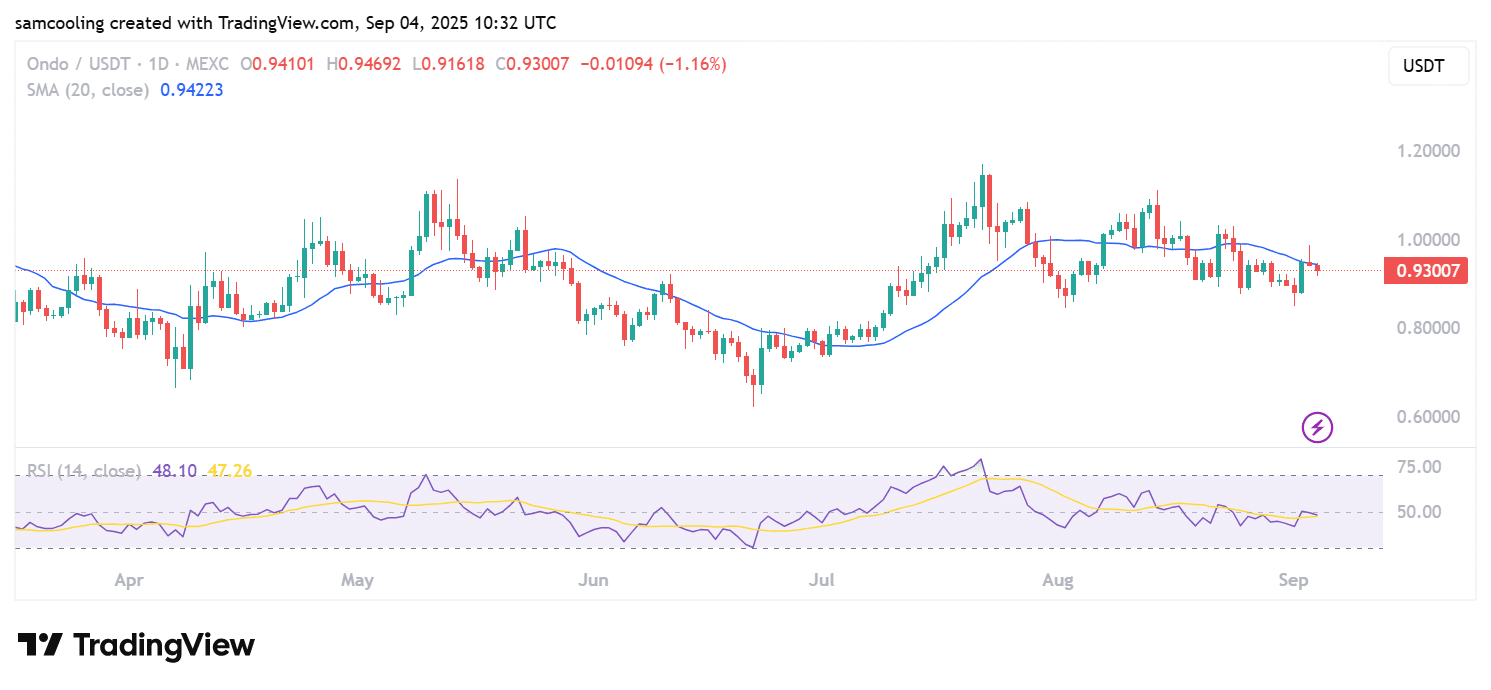

According to TradingView data, the ONDO price is trading at $0.93 and has declined slightly by -1% during the session.

Despite this, ONDO is still holding gains after a sharp rally following the announcement.

(Source – ONDO USDT, TradingView)

The chart shows a strong reversal after a period of selling pressure that had pushed the token below $0.87 at the start of September.

The buyers acted aggressively after the Global Markets news, and the token reached intraday highs of $0.9718. The tall green candles assure us of the high demand among the buyers, particularly during the past two days.

This rebound volume soared up to 389.9K, significantly more than the late-August average.

This is where a tidal wave of investors came in, with Ondo getting coverage around its Wall Street 2.0 narrative. It also indicates that traders could be pricing ONDO with the prospect of long-run on-chain equities in mind.

Crypto Winkle wrote on X that this update could turn Ondo Finance into a leading force in the RWA market.

Markets are goinng global with $ONDO.

Ondo Global Markets debuts with 100+ tokenized stocks & ETFs now live on Ethereum, a defining moment that brings traditional markets onchain at scale.

The chart looks perfect – one of the strongest setups out there. With tokenized RWAs… pic.twitter.com/VngaHdHOM1

— Crypto Winkle (@CryptoWinkle) September 3, 2025

He suggested Ondo may become a key player if traditional markets continue moving on-chain.

He also shared the ONDO/USDT daily chart, which shows a strong setup after months of consolidation.

(Source: ONDO USDT 1-D Chart – Crypto Winkle – X)

The ONDO price moved between a rising support line and a falling resistance trend. That wedge pattern has now been broken to the upside, which signals a clear shift in sentiment.

The zone between $0.43 and $0.60 worked as firm support.

It stopped several attempts at deeper declines, and the breakout above resistance near $0.95 points to fresh bullish momentum.

DISCOVER: The Best RWA Crypto to Buy in 2025 – September Update

Can Ondo’s Custody Model Connect Traditional Finance With Blockchain?

The launch also has the backing of a wide range of wallets, custodians, exchanges, and DeFi platforms.

Early adopters include Bitget Wallet, Trust Wallet, OKX Wallet, Gate, Chainlink, Blockchain.com, MEXC, LBank, 1inch, CoW Protocol, Alpaca, LayerZero, Morpho, Gauntlet, BitGo, Fireblocks, Ledger, Zodia, CoinGecko, CoinMarketCap, and RWA.xyz.

2/ Ondo Global Markets launches with support from many of the world's leading applications and platforms, including:

Bitget Wallet (@BitgetWallet)

Trust Wallet (@TrustWallet)

OKX Wallet (@wallet)

Gate (@Gate)

Chainlink (@chainlink)

Bitget Global (@bitgetglobal)… pic.twitter.com/E2B6TyyJYh— Ondo Finance (@OndoFinance) September 3, 2025

Developers are also part of the plan, which includes Ondo providing APIs for integration into apps, exchanges, robo-advisors, and derivatives platforms. This allows easy access to tokenized U.S. stocks within different services.

Ondo’s setup involves using a US-registered broker-dealer to purchase and hold real securities, such as AAPL shares.

In return, the investor receives an on-chain token like AAPLon, which mirrors the full economic rights of the asset.

These tokenized assets work as total return trackers. That means dividends are reinvested automatically into more tokens, minus any withholding taxes.

As a result, the value of each token reflects the complete return of the underlying security.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The post Inside ONDO Crypto Plan To Take Wall Street On-Chain: Are Stocks Finished? appeared first on 99Bitcoins.