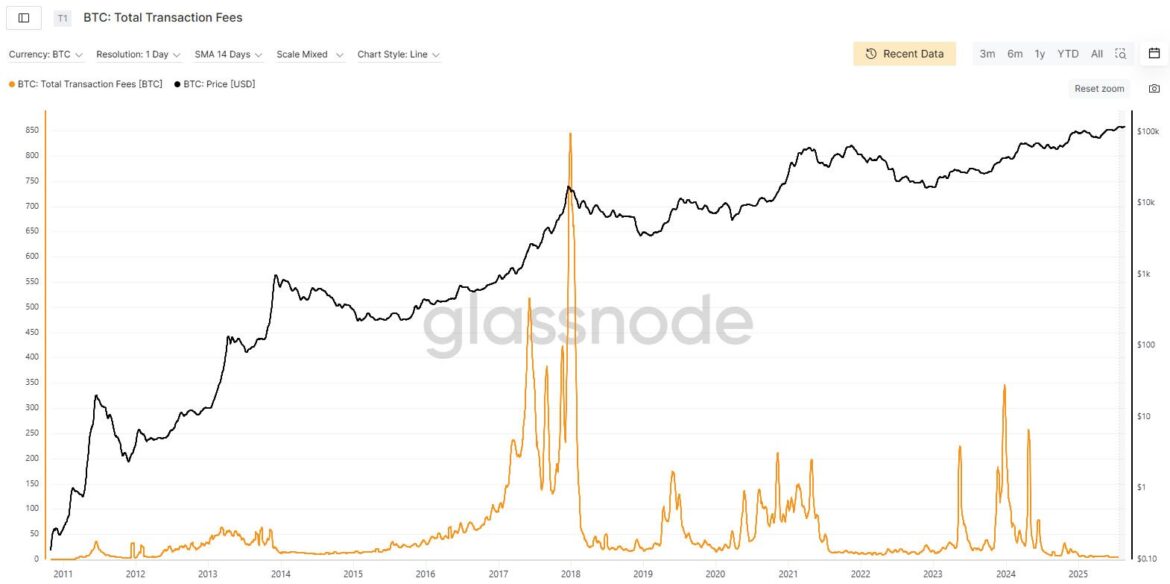

Bitcoin transaction fees have fallen to their lowest level in over a decade, and everyone is talking about the health and viability of the largest digital asset.

According to Glassnode, the 14-day simple moving average of daily fees on the Bitcoin blockchain is now 3.5 BTC per day. The last time fees were this low was 2011, when Bitcoin was still in its early days.

This is an interesting development.

Despite bitcoin trading above $110,000, miners are collecting less in fees than at any point in the last 14 years. Historically, fees rise during bull runs when network congestion drives up competition for blockspace. This time, it’s broken the pattern.

Analysts point to several reasons for the drop in Bitcoin transaction fees.

One is a weaker demand for blockspace as Bitcoin is being used more as a store of value than a payment network. With prices climbing, investors are holding the asset as digital capital rather than using it as a medium of exchange.

At the same time, scaling solutions like SegWit and the Lightning Network have made Bitcoin more efficient, reducing the need for users to pay higher fees.

Lightning network, for example, opens channels with a single on-chain transaction, and after that all, transactions are conducted cheaper and off-chain.

In 2023 and 2024, the rise of NFTs on the Bitcoin blockchain, such as Ordinals and Runes, caused a massive surge in bitcoin transaction fees, sometimes pushing the cost of a single transaction to up to $50.

But those days seem to be over now, and the NFT activity on the blockchain has subsided significantly.

Galaxy Digital noted that in recent months, nearly 50% of all Bitcoin blocks have been under-filled, even though they had space to include more transactions. “These blocks fail to reach the maximum weight limit (4,000,000 weight units) despite room to include additional transactions,” they said.

For Bitcoin miners, this is bad news. After the 2024 halving reduced block rewards to 3.125 BTC, many expected transaction fees to make up for the lost revenue. Instead, the opposite has happened.

Bitcoin transaction fees are so low that the average cost of sending a TX dropped to $0.67 on August 23, 2025 – down 10% from a year ago. This means miners are still heavily reliant on block subsidies, which will continue to shrink with future halvings.

Related: Bitcoin Miners are Switching to AI and HPC | Report

This could break the long-term security model.

Analysts say that without enough economic incentives, smaller operators will struggle to make a profit and concentration of mining power among fewer bigger players could happen. In the worst-case scenario, it could make the network susceptible to 51% attacks or censorship risks.

The upside to this situation is that lower costs make Bitcoin more attractive for everyday use and payments, something high fees used to discourage.

For now, Bitcoin’s fee market is quieter than it has been in 14 years. Whether that’s a sign of a more efficient system or an early warning sign of declining activity is unclear.

What is clear is that the balance between block subsidies and transaction fees will be key to Bitcoin’s long-term viability. If fees stay low, miners’ profitability — and therefore the network’s security — will face more challenges.