The Bitcoin price is currently at $107,050, having climbed 1.5% overnight, and is showing increasingly bullish strength amid the ongoing Israel-Iran conflict, with tomorrow’s Federal Reserve FOMC Meetings looming.

Tomorrow, the Fed will announce its plans for interest rates, with prediction platform Polymarket having ‘No change’ sitting at 98% chance of being correct and a 25 bps decrease at 2%.

I think you need to put $BTC in context.

We made a new ATH 3 weeks ago.

We’re consolidating above former ATHs.

We’ve corrected 5% from ATHs.Yes the LTF is choppy and has news pressure.

But don’t let the effects of zooming in distract from what this chart really looks like. pic.twitter.com/Hc3sXcl2V8

— Cold Blooded Shiller (@ColdBloodShill) June 15, 2025

Bitcoin Price Perfectly Positioned For A Big Move To The Upside Heading Into FOMC

With the Fed’s FOMC meetings just a day away, Bitcoin is sitting just 4.2% away from breaking a fresh all-time high, which came less than a month ago when it hit $111,814 on May 22.

Regardless of outside world events, namely the conflict between Iran and Israel, which has seemingly escalated following a possible hit on the US Embassy in Tel Aviv, Bitcoin seemingly can’t be stopped.

If these events had occurred just a few months ago, BTC would’ve likely broken structure and plummeted below $100k. However, Bitcoin price has retested the sub-$103,000 level twice already this month, and both times, it bounced perfectly off of support and back above $105,000.

Zooming out on the chart, Bitcoin looks incredible on an HTF (high time frame). Even though current world affairs and looming FOMC meetings make BTC look slightly choppy on an LTF (low time frame), it is still an incredibly bullish chart after holding steady above the war breakout level of $103,800.

A 25 bps cut from the Fed or an announcement of no change will likely see Bitcoin price head for fresh all-time highs as risk assets will continue to see heavy inflows from institutional and retail investors.

DISCOVER: Top 20 Crypto to Buy in June 2025

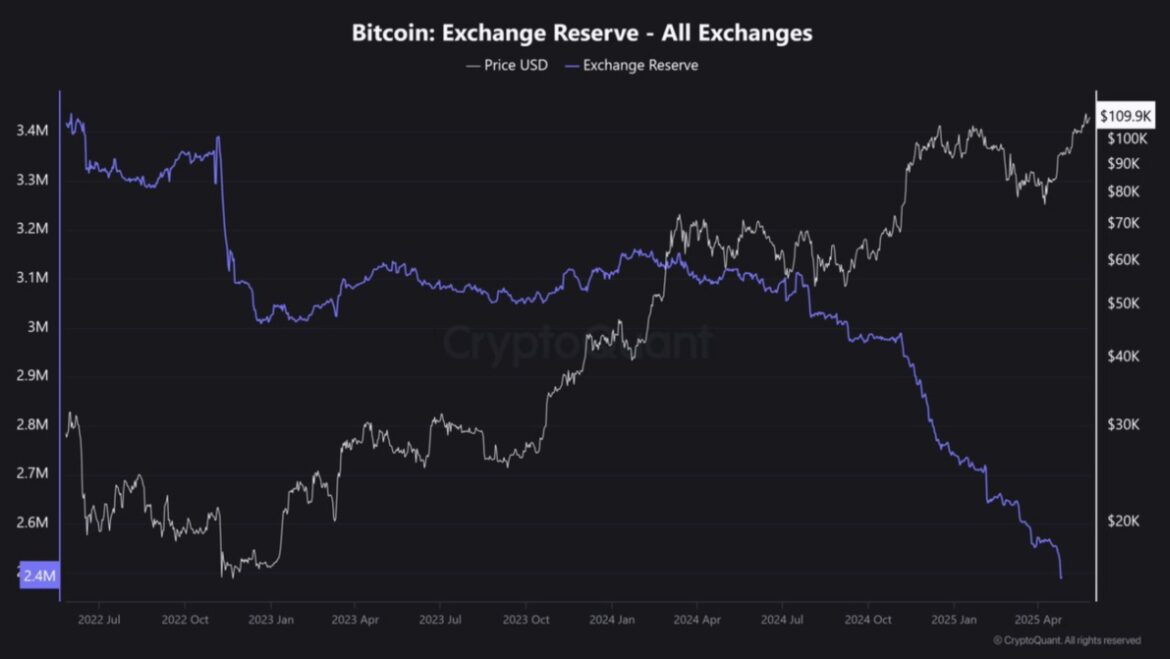

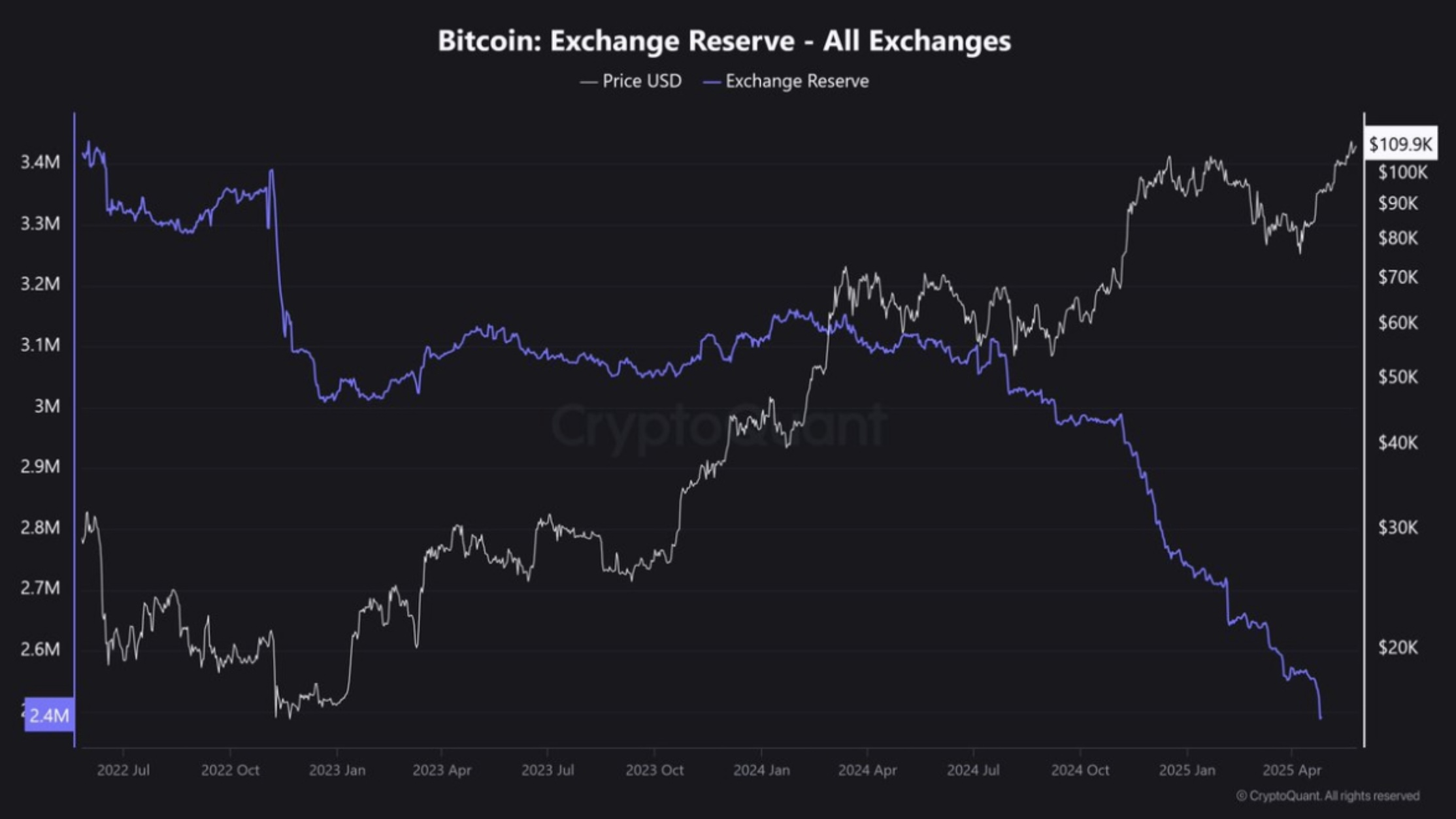

Exchanges Are Running Out Of Bitcoin: Another Signal That A Huge Move Is Likely On The Way

(SOURCE)

As the Bitcoin chart continues to hold steady just below its all-time high, BTC supply on exchanges is vanishing. The last time this happened, Bitcoin exploded.

There was a huge exodus of BTC from exchanges in late 2022 and into early 2023. At the same time, the Bitcoin price went from $16,600 to nearly double to $31,000 by April 2023.

This key indicator is leading many traders and analysts to believe that the supply shock caused by the lack of available Bitcoin will lead to the true BTC pump of this bull market cycle.

Considering notable figures such as Binance founder CZ, who stated his belief that Bitcoin’s price could exceed $500,000 this cycle, coupled with the strength shown by the leading digital asset in the face of a WW3 breakout, those lofty BTC targets seem more real than ever.

Institutions Continue To Buy Bitcoin And Ethereum While Retail Investors Stay Sidelined In Fear

BLACKROCK HAS BOUGHT ETH FOR 9 DAYS IN A ROW

BlackRock’s ETHA ETF has received over $492M of inflows in the past 9 consecutive trading days.

Good morning Ethereum Bulls. pic.twitter.com/liWW1HcLpz

— Arkham (@arkham) June 6, 2025

Not only does the Bitcoin price look great from a TA perspective, but the fundamentals are extremely bullish right now. Japan’s MetaPlanet just this morning announced a fresh 1,112 BTC buy, totalling $116.5 million.

This increases MetaPlanet’s holdings to 10,000 Bitcoin, moving it above Coinbase to 9th place in the largest Bitcoin holders list. It now sits behind the Hut 8 Mining Corporation, which holds a reported 10,273 BTC. One more purchase from MetaPlanet could see the Japanese firm overtake Hut 8 into 8th place.

On the Ethereum side, crypto intelligence platform Arkham posted nine days ago that BlackRock has been consistently buying ETH, adding $492 million worth in just a nine-day accumulation period.

While many retail investors are scared to buy the dip with the ongoing conflict in the Middle East, institutions such as MetaPlanet and BlackRock are buying Bitcoin and Ethereum at discounted prices. As the old adage goes, ‘scared money don’t make money’, and these firms live by that motto.

The likely outcome from this week is the Fed announcing rates to be cut by 25 bps or stay flat, and a possible de-escalation in the Middle East. These outcomes will likely be the springboard for an inflow to risk assets, led by Bitcoin price printing fresh highs and Ethereum regaining $3000 before pushing on toward its previous all-time high of $4878, per CoinGecko.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Bitcoin Price: FOMC To Spark Mega Rally as Israel Goes to War appeared first on 99Bitcoins.